The cost of solar energy production has plunged, but it needs to fall further

DOI: 10.1063/PT.3.4769

Although solar energy usage has grown dramatically in the US over the past decade, far more dramatic growth will be needed if the nation is to meet President Biden’s ambitious plan to decarbonize the US electricity system by 2035. Solar provided just 2.3% of US electricity production last year, according to the US Energy Information Administration. The Department of Energy says solar will need to supply 30–50% of total US power needs in a zero-carbon electricity system.

Solar installations of photovoltaics (PVs) in the US had a capacity of 19.2 GW of direct current (GWdc) last year, according to the Solar Energy Industries Association. That was a 43% increase from 2019 installations, and it brings the total installed US capacity to 97.2 GWdc. Capacity values reported in DC typically are 10–30% higher than those reported in AC capacity, according to the Energy Information Administration. That is because the output of a PV system depends on the availability of sunlight, and the output of panels may reach their peak capacity only a few hours out of the year.

Solar energy ranked first among new electricity-generating sources in the US during the past two years and accounted for 43% of all new electricity capacity in 2020. According to the consulting firm Wood Mackenzie, the US solar industry is expected to quadruple in capacity in the next decade, to more than 400 GWdc.

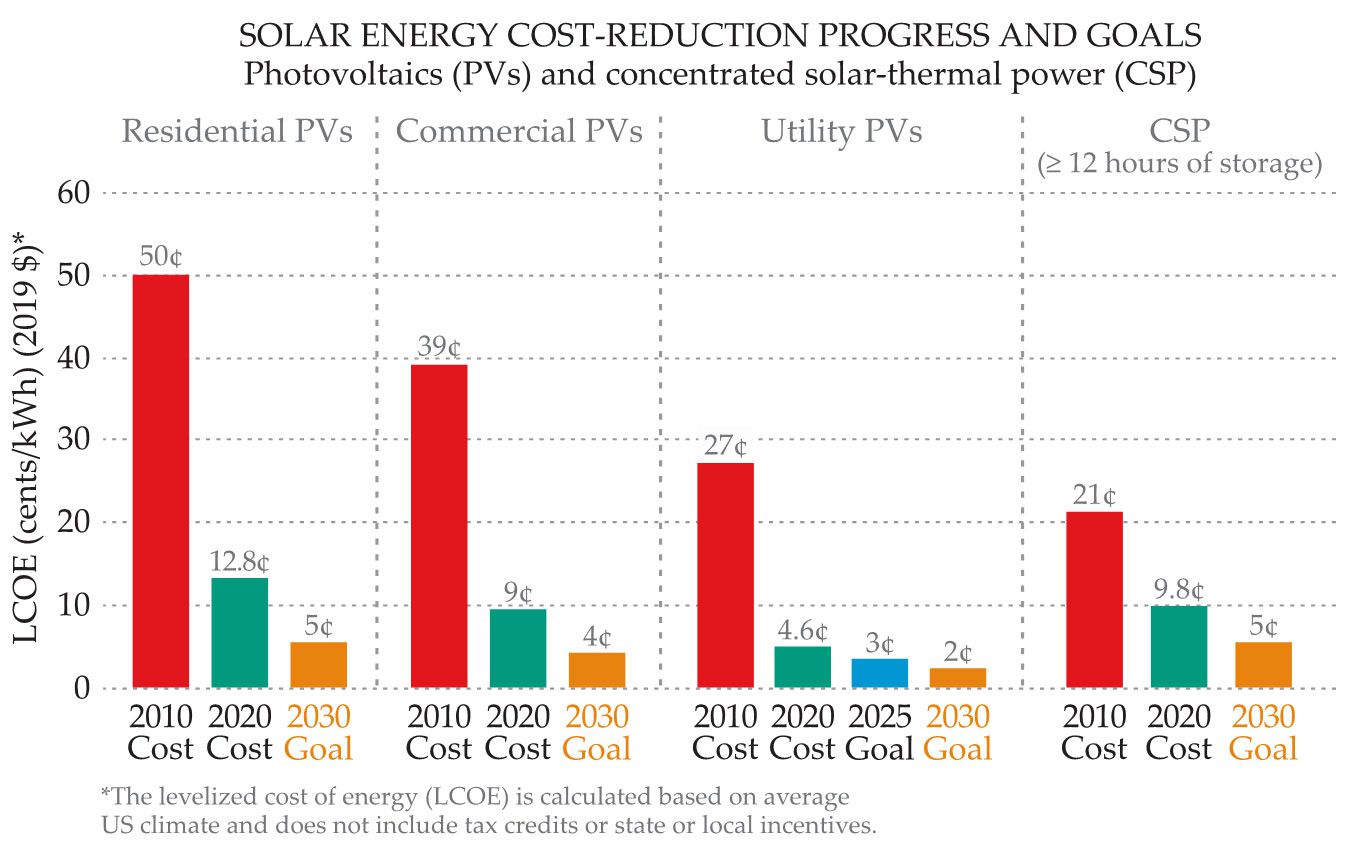

In March, DOE announced a new goal to cut the cost of utility-scale PV energy 60% by 2030. The new levelized cost of energy (LCOE) for grid-scale solar, 2 cents per kilowatt hour, represents a cut to less than half the current average of 4.6¢/kWh. LCOE is an estimate for the revenue required to build and operate an electricity source over a specified period. The agency moved up its previous 2030 target of 3¢/kWh to 2025.

A 2.8 MW solar array located in Wareham, Massachusetts. In a carbon-free scenario, solar energy is likely to make up 30–50% of the US’s electricity generation by 2050.

STEPHEN COFFRIN

The proposed cost-target cuts for PV systems come atop the steep reductions that have been achieved in the past decade. (See the figure on page 28.) Today PVs are the cheapest electricity source in parts of the Sun Belt when the Sun is shining. BloombergNEF, a research consultancy, projects that the capital cost for a typical 10 MW utility-scale PV plant in the US will drop by more than 50% by 2030, to $400 million, from $840 million today.

But as PV systems start meeting a more significant fraction of total demand, PVs’ intermittency becomes a serious impediment to further deployment, a DOE official says. That variability will be addressed with batteries and other types of energy storage, which add significantly to the total cost of solar. The new DOE goals reflect the need to offset the storage costs to allow solar power to compete with other nonintermittent electricity-generating sources. Natural gas is the lowest-cost and largest source of nonintermittent power.

Hundreds of gigawatts

In 2012, at the outset of the SunShot Initiative, the Obama administration’s cost-reduction effort, LCOE targets for utility-scale PVs in 2020 were set at 6¢/kWh. That goal was met four years early, and the 3¢ target was instituted for 2030. To set benchmark LCOE values as an average value for the nation, DOE calculates them for one location that has moderate solar resources, such as Kansas City.

Becca Jones-Albertus, director of the solar energy technologies office in DOE’s Office of Energy Efficiency and Renewable Energy, says Biden’s zero-carbon plan will require hundreds of gigawatts of new solar capacity through 2035. “We need to increase annual deployments by a factor of two to five. One of the most effective ways to increase deployments is to drive down costs.”

Costs of utility-scale, commercial, and residential photovoltaics have all fallen sharply over the past decade. Future reductions are likely to be less dramatic. (Courtesy of DOE EERE.)

But costs for utility-scale systems have already plunged by as much as 80% in the past 10 years, driven by myriad technology developments. Crystalline silicon wafers have increased in size from 156 mm2 to as much as 210 mm2. The larger size means fewer connections and reduced efficiency losses from spacing and contacts, says Arnulf Jäger-Waldau, senior scientist at the energy efficiency and renewables unit of the European Commission. Wafers, the slices of silicon from which solar cells are fabricated, have also gotten thinner, which has lowered their manufacturing costs. More-efficient monocrystalline PV cell technology has overtaken multicrystalline cells in market share over the past five years, notes David Feldman of the National Renewable Energy Laboratory (NREL).

As a result, solar panels, which package dozens of cells, have more than doubled in efficiency from around 10% in the early 2000s. John Rogers, a senior energy analyst at the Union of Concerned Scientists, notes that his rooftop panels in northern Massachusetts are 22% efficient. “The panels I put on my roof five years ago are 360 watt, and you can get 400-, 450-watt ones and larger.”

The scope of utility-scale projects also has increased and has resulted in a lower cost per unit of energy. “We’re now seeing projects in the hundreds of megawatts,” says Rogers. “I remember 20 years ago, when someone said we’re going to do a one-megawatt project, I thought, ‘Yeah, sure you are.’”

Cost reductions and demand growth to date have resulted from a “virtuous cycle,” Rogers says. “You had the tax policy in the 2009 [American Recovery and Reinvestment Act] stimulus that increased demand, which drove supply, which brought down costs, which increased demand. That cycle has kept costs going down a whole lot further and faster than I would have imagined.”

DOE left unchanged the cost targets it set for commercial- and residential-scale PV installations in 2016, as it did for concentrated solar-thermal power (CSP). In that technology, sunlight from hundreds of mirrors is reflected onto a central tower and produces heat that is absorbed by a medium such as molten salt. The thermal energy is used to drive electricity-generating turbines.

The LCOE targets for residential- and commercial-scale installations are set at 5¢/kWh and 4¢/kWh, respectively. Their current values are 12.8¢/kWh and 9¢/kWh, respectively. Meeting them by 2030 will be a challenge, says a DOE official.

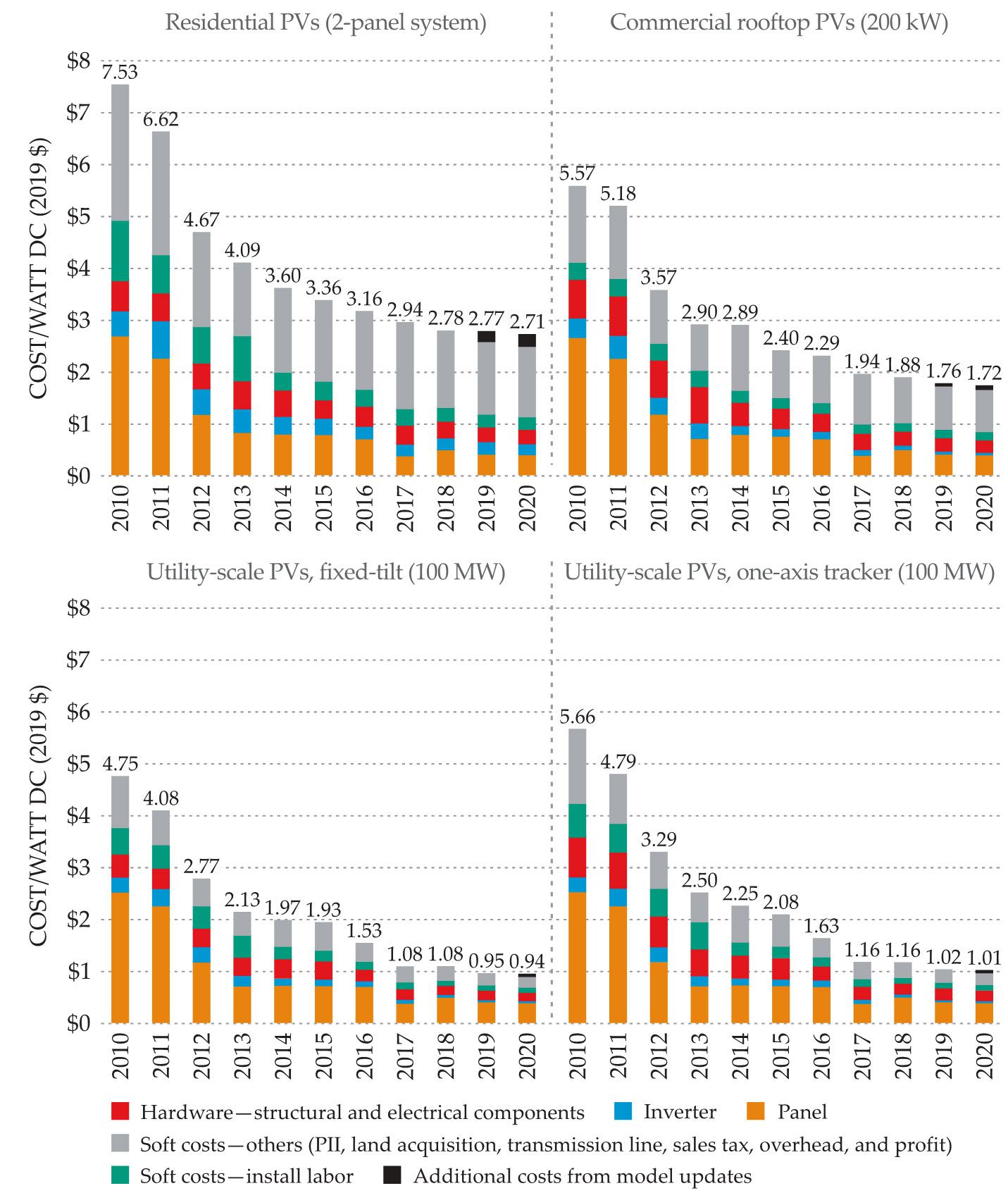

Most of the higher costs for residential and commercial installations are attributable to nonhardware, so-called soft costs. (See the figure on

Soft costs have declined significantly for all types of solar energy systems, but they remain proportionally greater for residential- and commercial-scale installations. The cost of solar panels has fallen steeply since 2010. Utility-scale panels can be fixed (lower left) or can track the Sun throughout the day (lower right). PII: permitting, interconnection, and inspection. (Courtesy of National Renewable Energy Laboratory.)

Focus on materials

Wringing additional costs out of solar energy has become more difficult. The pace of annual cost reductions has slowed significantly in the past two years, compared with the steepness of the early 2010s, NREL statistics show. “The easy wins are over,” says Jones-Albertus, and further reductions will need to come from “all of the cost buckets.” That includes driving efficiency improvements in today’s two commercial technologies, crystalline silicon and cadmium telluride, to near their theoretical limits. Industry adoption of multijunction cells, consisting of two or more stacked semiconductor layers with different bandgaps, will improve efficiencies by making use of a larger portion of the solar spectrum. And bifacial modules, which capture photons that are reflected off the ground to the back side of panels, might increase efficiencies by 5–10%, Feldman says.

Crystalline silicon currently accounts for 80% of the US PV market, and that technology will continue to dominate the PV landscape for the next decade, say market analysts. The remaining 20% is CdTe, which is the exclusive global realm of one US company, First Solar. DOE in March awarded $20 million to the NREL to set up a consortium that aims to increase domestic CdTe PV material and panel production, achieve cell efficiencies above 26%, and decrease panel costs.

The barriers to entering the CdTe market are high, says Jäger-Waldau. First Solar’s technology is proprietary, so unlike silicon, off-the-shelf manufacturing equipment isn’t available. “You need knowledge of the production process, and you need a fundamental understanding of the material properties. That requires a substantial research department, and it’s difficult for newcomers without [sales revenue] to finance that.”

What’s more, cadmium is toxic. Its use is limited by the European Union’s Restriction of Hazardous Substances Directive. However, CdTe’s melting point is three times that of cadmium, says a First Solar spokesperson, adding that the compound’s high stability and its insolubility in water limit its bioavailability in the event of an accident.

Although tellurium, produced as a byproduct of copper mining, is about as rare as platinum, the First Solar spokesperson points to an NREL analysis that found that the supply of tellurium should be sufficient to support annual production of 100 GW’s worth of CdTe thin films. The company’s current annual manufacturing capacity is just over 6 GW.

Perovskites, such as a hybrid organic–inorganic lead or tin halide–based compounds, have the potential to make highly efficient thin-film solar cells with very low production costs. (See Physics Today, May 2014, page 13

“There’s a danger that perovskites are the shiny new object, but we have seen incredible gains in efficiencies in the last few years, particularly when paired [in tandem cells] with silicon,” says Rogers. Whereas a conventional monocrystalline silicon cell has achieved 26% efficiency in the lab, pairings with perovskites have reached 29%, he says. Challenges include lifetime stability and manufacturing perovskites at scale. “The technologies today last on the order of months; we need them to last for years and decades,” says Jones-Albertus.

In addition to cheaper cells and panels, achieving the DOE cost target will require lowering the price of other hardware, including inverters, wiring, and systems to reposition and orient the panels as the Sun moves, says Jones-Albertus.

Concentrated solar thermal

DOE is supporting research on solar thermal energy principally as a way to store heat for electricity generation when the Sun doesn’t shine. Storage capability increases the value of CSP relative to cheaper PVs, says Jones-Albertus. The department’s cost target for CSP is 5¢/kWh by 2030—half its current cost.

Utility-scale energy storage with long duration—six hours or more—grows in importance as wind and solar generation grow. According to Mark Mehos, the NREL group manager for thermal systems R&D, various analyses have shown that if the 5¢ target is achieved, CSP with thermal storage for long durations will be less expensive than the combination of PVs and batteries, since CSP scales more efficiently. “To hit Biden’s 2035 target, you will need long-duration storage,” he says.

A number of ways are available to improve the efficiency of heliostats, the thousands of mirrors that are arrayed in a CSP plant to reflect sunlight to the central concentrator. Heliostat costs, which have been halved in the past decade to $100/m2, could again be halved, says Mehos. Increasing reflectivity from 93% to 97% would reduce the number of mirrors required at a plant. It might be accomplished either by reducing the thickness of the glass covering the silver reflective material or by replacing the glass with a polymer substrate.

DOE is supporting the development of silica particles that could replace molten salt as the heat-transfer medium. Those particles, which Mehos says are “dirt cheap,” can be heated to around 800 °C, compared with the 565 °C maximum for salt. The higher temperature could allow supercritical carbon dioxide to replace steam for driving electricity-generating turbines. The improvement in thermodynamic efficiency from that cycle could reduce the size of power stations to as little as one-tenth that of a modern coal power plant. That could help ease the financing of CSP plants, which are large capital projects.

More about the authors

David Kramer, dkramer@aip.org