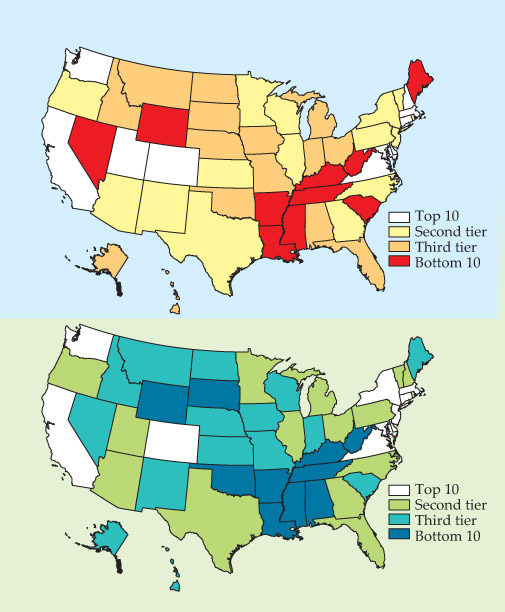

Rankings place technology-courting US states on top

DOI: 10.1063/1.3580488

“Utah is in the ranks of the big boys now,” says Ross DeVol, economic research director at the Milken Institute, a California-based nonprofit that periodically evaluates the 50 states on their success at converting R&D into products, companies, and high-paying jobs. Known more for coal mines and oil refineries than for a high-tech business culture, Utah placed near the top in 2010 rankings recently released by the Milken Institute and by the Washington, DC–based Information Technology and Innovation Foundation (ITIF), which independently conducts a similar assessment.

Utah’s success is used by both organizations to illustrate a wider trend: States that invest in basic R&D and technology commercialization are more likely than those that don’t to create new businesses and jobs over the long haul. “You can explain about two-thirds of a state’s economic performance by its innovation activities and its high-tech sector,” says DeVol, coauthor of the Milken Institute’s State Technology and Science Index, which focuses on such measures as total levels of R&D funding, access to financial capital, and growth rate of high-tech firms. The ITIF State New Economy Index looks at how a state’s high-tech economy is affected by globalization and how its public and private sectors embrace information technology. In 2010 Massachusetts took first place on both indices; the state has held those first-place rankings since the Milken Institute and ITIF indices were first introduced, in 2002 and 1999, respectively.

Planting technology parks

Massachusetts got high marks for its cluster of software, hardware, and biotechnology companies and for its research universities, which generate scientists and intellectual property that often flow to the state’s technology companies. The state is also credited for its commitment to long-term R&D projects, including a 10-year, $1 billion life sciences initiative that will provide $23.9 million in tax incentives this year for biotechnology companies that pledge to create 1000 jobs in the state.

The greatest natural resource that Massachusetts has is its “unrivaled group of terrific research universities where extremely bright people are doing extremely creative things,” says physicist Jack Wilson, president of the University of Massachusetts system. In recent years the state has facilitated several public–private partnerships, including the $95 million Massachusetts Green High Performance Computing Center, a joint initiative of UMass, MIT, Harvard University, Boston University, and Northeastern University. Scheduled to be completed in 2012, the multidisciplinary center also receives funding from the state and from local technology companies EMC and Cisco.

In 2010 Delaware climbed from 14th in 2008 to 10th on the Milken Institute index and from 7th in 2007 to 6th on the ITIF index. This year the University of Delaware begins construction of a 1.1-square-kilometer science and technology campus on the site of a shuttered Chrysler assembly plant. "[The campus] is our next 100 years of growth,” says university president Patrick Harker, a former engineering and business professor. “Our plan for building out the property aligns with the university’s R&D priorities: energy and the environment, life and health sciences, and national security and defense.”

Finding the sweet spot

Like Delaware, Utah moved up in the 2010 rankings, jumping three spots to 5th on the Milken Institute index and one spot to 12th on the ITIF index. Much of the credit is given to the Utah Science Technology and Research initiative, established by the state government in 2006. Since then, the initiative has spawned 20 startup companies and 2300 new jobs, thanks to the hiring of 40 out-of-state academic researchers who have brought in more than $66 million in research grants.

A key feature of the initiative was hiring “new people with new ideas that match existing strengths,” says Thomas Parks, University of Utah vice president for research. Those strengths include space environment sensors and agriculture at Utah State University and imaging and bioengineering at the University of Utah. In its latest initiative, Utah looks to ramp up research and innovation of clean-coal and renewable-energy technologies by forming a research triangle among the University of Utah, Utah State University, and Brigham Young University and strengthening collaborations with neighboring national laboratories in Idaho, New Mexico, and Colorado.

“High-ranking states are knowledge driven, investing in higher education and attracting managerial and tech firms,” says Scott Andes, a research analyst at ITIF. “Low-ranking states are almost exclusively resource driven; they continue to rely on such 20th-century industries as coal, agriculture, and minerals.” For example, West Virginia and Mississippi find themselves at the bottom of both indices. But low-ranking states sometimes outpace others in job creation, Andes says. He points to Wyoming, which ranked 46th on the ITIF index but had one of the largest rates of job creation in 2009 and 2010 due to higher-than-normal revenues from a global increase in mineral prices. A more sound long-term economic strategy, Andes suggests, is for states to find “the sweet spot between R&D and high-value manufacturing.”

Dan Berglund, president and CEO of the Ohio-based State Science and Technology Institute, which advises states on technology-based economic development, says that state governments usually take the lead in technology commercialization. But he points out that a critical component of the process, basic research, is funded primarily by the federal government. One concern, Berglund says, is the increasing number of foreign scientists and engineers who graduate from US universities and return home to developing nations. According to the Battelle–R&D Magazine 2011 Global R&D Funding Forecast, some of those nations are driving an expected 3.6% global increase in R&D spending in 2011.

China is expected to increase its R&D expenditures by 9.2% in 2011, while the US, still the top R&D funder, is expected to increase spending by 2.8%, with about one-third of that coming from the FY 2011 federal budget. The impact from the loss of human and financial capital to spur US innovation will be felt at the state level, says Berglund. “The question is, What is the federal government going to do about it?”

US states are ranked according to the economic impact of their technology investments. Shown above, the 2010 State Technology and Science Index (Milken Institute, Santa Monica, California) evaluated states’ technology commercialization output; shown below, the 2010 State New Economy Index (Information Technology and Innovation Foundation, Washington, DC) also covered a state’s ability to adapt to a high-tech global marketplace.