Gradual path proposed to empty helium reserve

DOI: 10.1063/PT.3.1945

Bipartisan sponsors of a House bill hope it will prevent an already severe helium supply crunch from worsening this fall if the federal government halts sales from the Federal Helium Reserve. Users of helium told lawmakers recently that the shortage is already the worst in decades.

“Unless Congress takes swift action, America will float off a helium cliff,” warned Representative Doc Hastings (R-WA), chairman of the House Committee on Natural Resources and one of the bill’s sponsors, at a 14 February hearing on the bill. “There are many who believe that the federal government shouldn’t be in the helium business, and I would agree. But we are and have been since the mid 1990s.” New legislation is required, he said, “because helium is too essential to suddenly shut off the valve at the reserve.”

The helium reserve has been declining since 1996, when Congress ordered its selloff. The reserve currently supplies 35% of world consumption and 42% of US demand. Proceeds are being used to repay $1.4 billion that was owed the Treasury for helium purchases made decades ago. The debt should be paid off by October, and absent new legislation, the Department of the Interior’s Bureau of Land Management (BLM), which operates the reserve, will lose its authority to continue selling.

A 2010 National Research Council committee concluded that the selloff was harming helium users (see Physics Today, March 2010, page 28

A similar bipartisan Senate bill to extend helium reserve operations died in committee last year, and one of its principal sponsors, Jeff Bingaman (D-NM), has since retired. At press time a measure hadn’t been reintroduced in the Senate.

Federal helium users, which include NASA and the Department of Energy, already receive preferential treatment and pricing over the private sector. Federal purchases from the reserve accounted for 10% of reserve sales in fiscal year 2012, according to Timothy Spisak, deputy assistant director of minerals and realty management at the BLM.

Price spike

The House measure would require that the price of helium be set at biannual auctions, to better reflect prevailing market conditions. Refined helium prices have more than tripled since 2000, to an estimated $6.13 per m3 in 2012, according to the US Geological Survey. But the government sells crude helium at a fixed price that is based on the 1996 law’s requirement that the BLM recover its operating costs as it sells off the reserve. Crude helium is 65–80% pure, and refined helium is 99.99–99.9999% pure. On 1 March the BLM announced a hike in its crude helium price to $84 per thousand ft3 from $75.75 per thousand ft3. The price for federal users increased from $65.50 to $67.75 per thousand ft3.

“The cheap price of federal helium creates disincentives for helium users to invest in conservation and recycling, it gives unfair market advantage to the handful of companies that are allowed to purchase helium, and it can depress exploration for new sources of helium,” Hastings said.

Several factors have contributed to the helium shortage. They include maintenance issues at helium plants in Qatar, Algeria, and Australia; the delay of a new plant in Wyoming; and plunging natural gas prices. A byproduct of natural gas production, helium occurs only in certain gas fields at sufficient concentrations—0.3% or more—to make it economically recoverable. Helium concentrations in the Hugoton and Panhandle fields adjacent to the reserve near Amarillo, Texas, are especially high. Shale gas, on the other hand, contains insignificant amounts of helium.

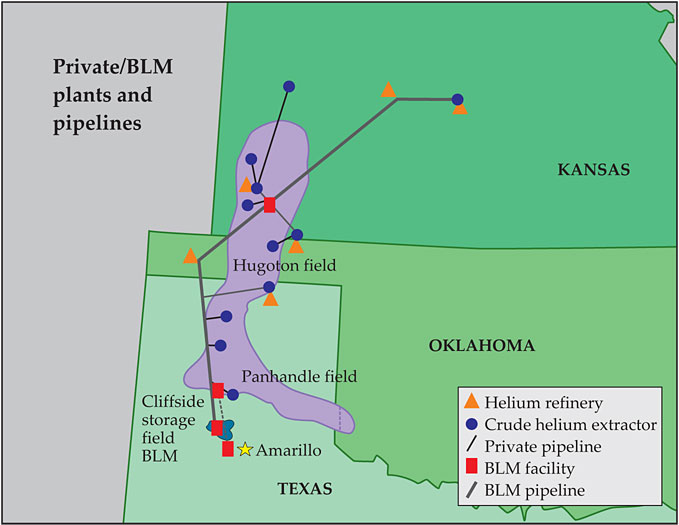

The BLM owns and operates an underground helium storage reservoir and a 724-km crude helium pipeline system that extends across the Hugoton and Panhandle fields from northern Texas into Kansas. Additionally, it operates a crude helium enrichment plant that then moves the product to six privately owned refineries along the pipeline (see the figure on page 28). In 2012 demand exceeded the enrichment plant’s 164 000 m3 per day capacity, and the BLM began allocating helium to the refineries.

In addition to the helium storage reservoir known as Bush Dome, located within the Cliffside storage field near Amarillo, Texas, the Federal Helium Reserve operated by the Bureau of Land Management includes a 724-kilometer crude helium pipeline and a helium enrichment plant. Six privately owned helium refineries tap into the pipeline and purify the gas for sale to end users.

BUREAU OF LAND MANAGEMENT

Rationing under way

The helium shortage has affected government and industry users alike. At the 14 February hearing, Sam Aronson, former director of Brookhaven National Laboratory, said that Argonne and Oak Ridge national labs have been receiving just 70% and 60%, respectively, of their helium allocations. Rodney Morgan, vice president of procurement for the semiconductor manufacturer Micron Technology, said his company has gotten 80% of the helium it contracted for over the past year. Helium is irreplaceable in semiconductor manufacturing as a carrier gas for deposition processes, as a dilutant in plasma etch processes, and in some specialized wafer cooling applications, he said. Brad Boersen, director of strategic planning and analysis for optical fibers at Corning, said the current supply shortage has been ongoing since the spring of 2012, far longer than a previous 2007 shortage, and is expected to continue indefinitely.

Aronson, vice president of the American Physical Society, pointed to a National Research Council recommendation that federal scientific research grantees be eligible to get reserve helium at the lower government price. Currently, he said, those small users face “severe supply constraints and price shocks which their research grants cannot accommodate. They are being forced to either shut down experiments, invest in expensive recycle equipment using their own resources, or, according to one nanotechnology researcher, switch to room-temperature experiments to continue their work in less-than-optimal conditions.”

The BLM has allotted 94% of the reserve sales in recent years to the four companies that own the refineries: Air Products and Chemicals, Linde, Praxair, and DCP Midstream. Other suppliers, who have been allocated the remaining 6% of available helium, must pay the refiners—who are also their competitors—to purify the helium before selling it to end users. While suppliers complain that refiners have been declining requests for their services, refiners counter that they have their hands full with their own sales and point out that they invested their own capital to build the refineries.

More about the authors

David Kramer, dkramer@aip.org