Global R&D spending up, US industry spending down

DOI: 10.1063/1.3490492

China and India will drive an overall increase in global R&D expenditures this year. At the same time, US science and technology companies are projecting modest reductions in their fiscal year 2010 budgets, according to NSF data and US industry surveys.

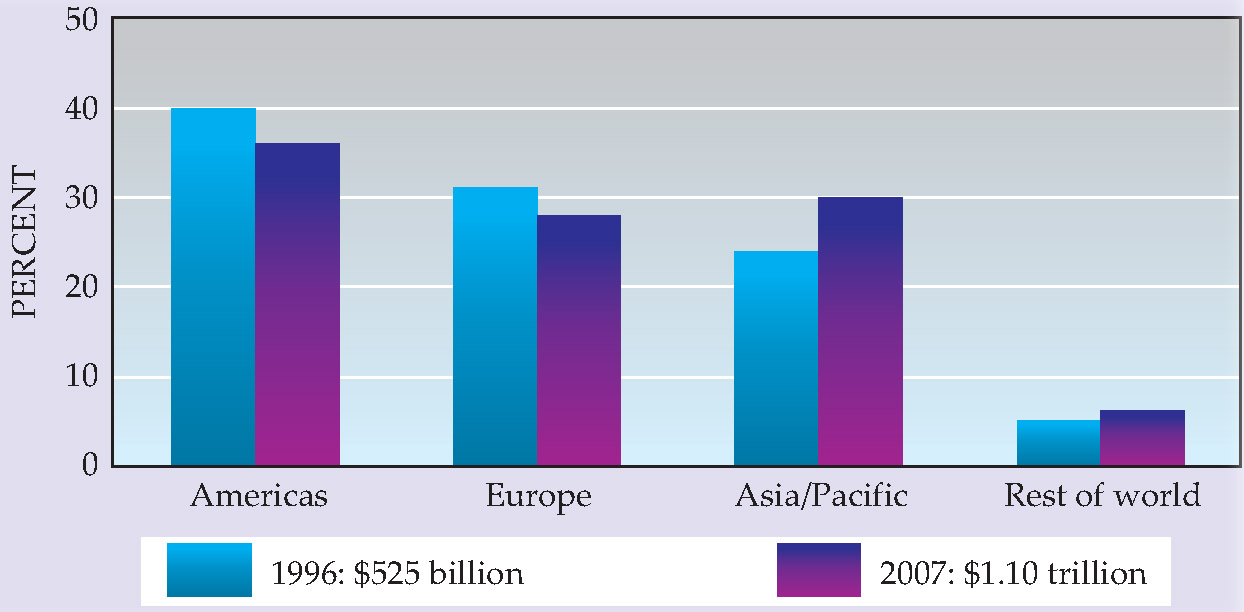

Worldwide R&D expenditures more than doubled over the past decade—jumping from $525 billion in 1996 to $1.10 trillion in 2007 (see figure). However, the 2010 Global R&D Funding Forecast by the Battelle Memorial Institute and R&D magazine shows that the trend flattened to $1.11 trillion in 2009; it predicts a jump to $1.16 trillion in 2010.

Estimated worldwide R&D expenditures: 1996 and 2007

NSG

Highlighted in both the NSF and the Battelle reports is that developing nations, particularly India and China, are snatching shares of total global R&D spending. As the table shows, the US and Europe accounted for a combined 60% of global R&D spending last year, down more than 7% from the 1996 number contained in the NSF bar graph. The Battelle/R&D magazine report also projects a 7.5% positive swing in R&D spending by the Asia/Pacific region this year; notably, Japan’s R&D spending is projected to decline. More modest increases of 3.2% and 0.5% are expected from the US and Europe, respectively.

Percentage share of total global R&D spending, 2008-10

| 2008 | 2009 | 2010 | |

|---|---|---|---|

| Americas | 39.9 | 39.4 | 39.2 |

| US | 35.4 | 35.0 | 34.8 |

| Asia/Pacific | 32.0 | 33.5 | 34.6 |

| Japan | 13.2 | 12.5 | 12.3 |

| China | 9.1 | 11.1 | 12.2 |

| India | 2.4 | 2.5 | 2.9 |

| Europe | 24.9 | 24.9 | 23.2 |

| Rest of world | 3.2 | 3.1 | 3.0 |

R&D MAGAZINE

Percentage share of total global R&D spending, 2008-10

Americas |

39.9 |

39.4 |

39.2 |

US |

35.4 |

35.0 |

34.8 |

Asia/Pacific |

32.0 |

33.5 |

34.6 |

Japan |

13.2 |

12.5 |

12.3 |

China |

9.1 |

11.1 |

12.2 |

India |

2.4 |

2.5 |

2.9 |

Europe |

24.9 |

24.9 |

23.2 |

Rest of world |

3.2 |

3.1 |

3.0 |

R&D MAGAZINE

In most industrialized nations, the private sector has traditionally been the biggest R&D spender—industry accounted for 67% of domestic spending in the US in 2008, according to NSF. But due to the worldwide recession, since 2008 the US and other governments have been spending billions to prop up industry in an effort to stimulate their economies. Still, this year many major US companies plan R&D spending reductions, particularly in-house basic research, according to the 2010 R&D Trends Forecast by the US-based Industrial Research Institute.

Many of the 92 companies (all of them headquartered in the US) that responded to the IRI survey plan to continue a decade-long trend of increasing their collaborations with federal labs and industry consortia. Survey responses also indicate where else industry R&D, and associated investments, have gone: Of those companies’ 187 non-US-based R&D labs, China is the top host, followed by Germany, the UK, and India.