Europe’s experiment in funding graphene research is paying off

DOI: 10.1063/PT.3.4811

In 2013 the European Union (EU) embarked on one of its three largest-ever targeted technology R&D programs, a 10-year, €1 billion ($1.18 billion) program called the Graphene Flagship, with the aim of creating applications and markets for the two-dimensional material and establishing Europe at the forefront of the technology. Ultimately, its impact and whether it has been worth the public spending and effort won’t be known for years to come.

“Over the past seven years, the Graphene Flagship has successfully brought graphene out of the lab, creating a fruitful European industrial ecosystem that develops applications of graphene and layered materials,” says the flagship’s 2020 annual report. “Today, our industrial family includes over 100 companies working together with the Graphene Flagship’s academic partners in fields ranging from the automotive and aviation industries to electronics, energy, composites and biomedicine.”

The EU launched another flagship, focused on the human brain, in 2013 (see Physics Today, December 2013, page 20

With two and a half years remaining, the Graphene Flagship claims to have spawned roughly 90 products that incorporate graphene in some way, with applications as disparate as Hall effect sensors that have 10 times as much sensitivity as their silicon-based counterparts and earphones with enhanced treble and bass. Other niche products include a bicycle tire with improved traction, a tennis racket with superior flexibility and durability, a motorcycle helmet with high-impact dispersion, and a high-performance air conditioner. Graphene chemical vapor deposition systems that are used in semiconductor applications originated from flagship R&D.

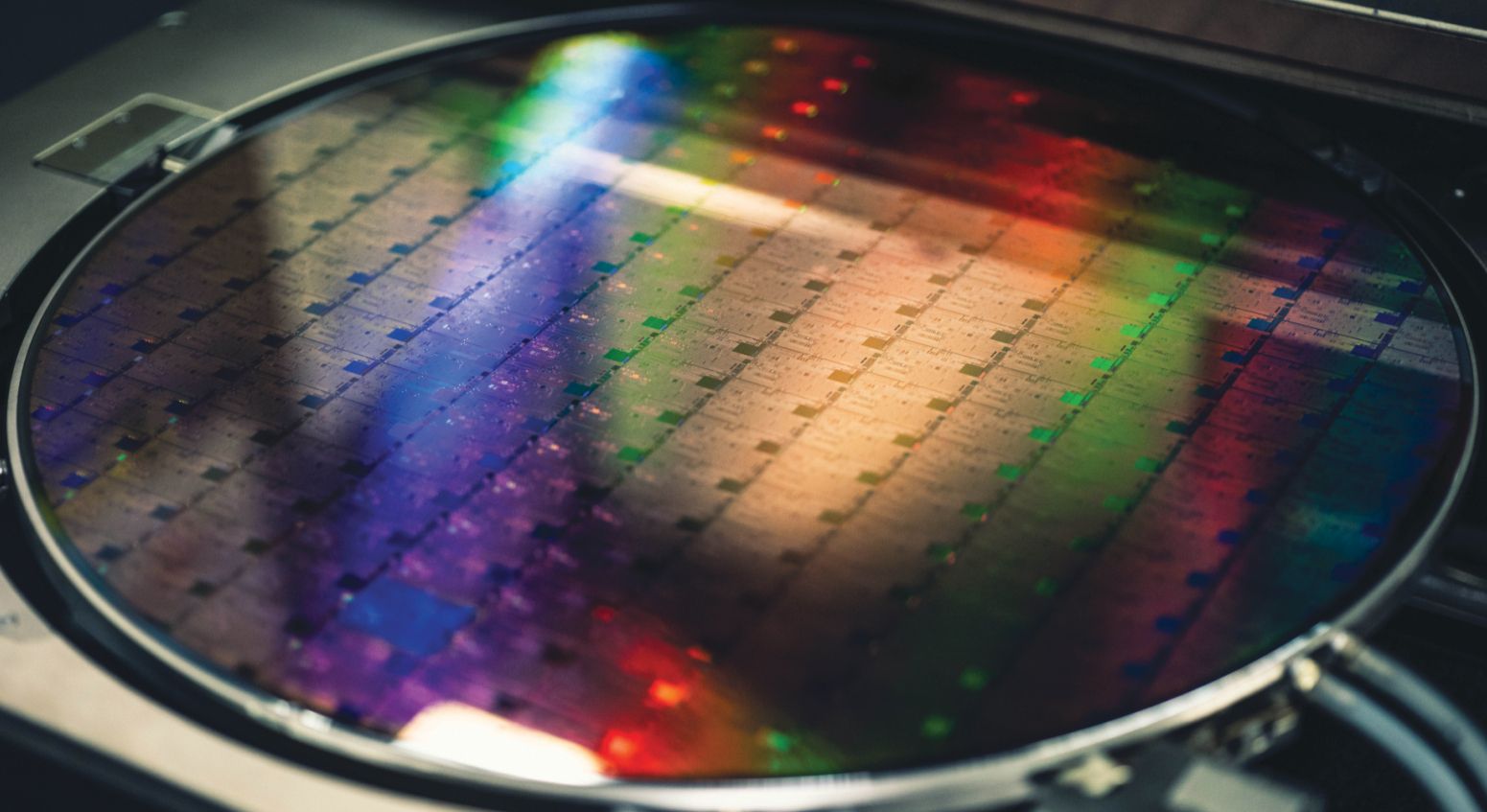

A graphene layer is deposited onto a silicon wafer for microelectronics and computing applications developed at Imec, the nonprofit Belgian nanoelectronics and digital technologies research institute.

IMEC

Measured by the number of patents and papers published per euro spent, “we do extremely well,” relative to the outputs of academic research, says Jari Kinaret of Chalmers University of Technology in Gothenburg, Sweden. The condensed-matter physicist has directed the Graphene Flagship from its outset. But few, if any, technology-specific collaborations on similar scales exist, so evaluations of the flagship’s performance are largely subjective. “I have had a standing offer for many years that if someone could come up with a measurable, meaningful key performance indicator, I will buy them a nice dinner,” Kinaret says.

Kari Hjelt, the flagship’s head of innovation, says a peer-reviewed assessment of its economic impacts will be performed once the program is finished. But he cautions that the scorecard will be incomplete because the time from research to commercialization typically is 15 years or longer. What is clear so far, he notes, is that the flagship has encouraged greater risk-taking on the part of European industry to venture into new product commercialization.

Unlike in the US, where industry is typically expected to put up some of its own funds for cooperative research involving government agencies, the Graphene Flagship reimburses its commercial partners for their direct R&D expenses. But the European Commission, which oversees the flagship, covers only a portion of the indirect or overhead costs that the industry partners incur, Kinaret notes.

The approximately 170 current flagship partners are about evenly divided between universities and industry. In the beginning, membership was roughly 75% academia. “But in all honesty, some of the industry partners were perhaps more spectators than players,” says Kinaret. The evolution to greater industry participation was anticipated in the road map that the flagship had drawn for itself at its outset, he says.

The flagship has €150 million left to spend through 2023. About 45% of that will fund applied research, and 15% will be devoted to basic research. Research is performed in four broad topical areas: enabling science and materials; health, medicine, and sensors; electronics and photonics integration; and energy, composites, and production.

Industry-led, multiple-institution programs designed to commercialize specific graphene products—Spearhead Projects—get another 30% of the flagship budget. The remainder goes to administrative support services, which include standards development, product performance testing, and governance.

Technology push

The 11 current Spearhead Projects were initiated last year and are due to wrap up by September 2023. By design, the projects can progress only to the prototype stage, Kinaret says. A special dispensation from the European Commission is required to proceed further. Full commercialization of products occurs outside the flagship program.

Letizia Bocchi, laboratory manager of filters and medical applications at Medica SpA in Italy, directs the Graphil Spearhead Project, which is developing water filters for drinking-water taps. The filters are made of graphene oxide embedded in hollow fibers that are spun from polymers. Graphene absorbs organic contaminants, such as antibiotics and perfluorinated compounds, that would otherwise escape the mechanical filtration provided by the fibers. Among other advantages, Graphil’s process doesn’t produce the wastewater that reverse osmosis does.

Graphene powder is produced for the manufacturing and energy industries by Graphene Flagship spinoff BeDimensional, an Italian company.

BEDIMENSIONAL

Two other companies, France’s Polymem and the UK’s Icon LifeSaver, are also Graphil partners, as are Italy’s national research institute, Chalmers, and the University of Manchester. A single company couldn’t have afforded the required R&D, Bocchi says, and government support was essential. “We are building up a plant dedicated to production of the fiber, which is a big investment.” The flagship’s high visibility throughout the EU has led to many contacts and expressions of interest from other companies, she adds.

The Circuitbreakers Spearhead Project is exploiting graphene’s self-lubricating properties to develop improved circuit breakers for protecting suppliers and consumers of electricity, such as wind farms, hospitals, and data centers. Grease, the existing century-old standard for ensuring the mechanical functioning of breakers, decomposes over time and must be replaced periodically. Anna Andersson, a principal scientist at Sweden’s ABB, leads the project. She says the researchers are evaluating the application of graphene coatings to metal substrates by using electroplating or sintering. The other industry members are materials producers Graphmatech of Sweden and Nanesa of Italy. Chalmers, Manchester, Greece’s Foundation for Research and Technology–Hellas, and the University of Rome Tor Vergata are the academic partners.

Aixtron machines perform chemical vapor deposition of graphene for compound semiconductor applications. The technology was developed by the German company through the Graphene Flagship.

AIXTRON

Another Spearhead, Autovision, aims to produce sensors for self-driving cars to detect objects and road curvature in dark or foggy conditions. Qurv Technologies, which leads the project, was spun out from the Spanish photonics research institution ICFO. Qurv’s graphene–quantum dot image-sensor technology features wide-spectrum computer vision technology that is compatible with the CMOS manufacturing process. Veoneer, a spinoff of Autoliv, the Swedish–US company that is the world’s largest supplier of automotive safety equipment, is an Autovision partner, as are the Belgian nonprofit Imec and German technology company Aixtron. If successful, the new sensors would provide an alternative to gallium arsenide and indium arsenide technologies, which require scarce metals and toxic arsenic.

A Spearhead Project, led by Airbus, seeks to develop a graphene-based thermoelectric ice-protection system for aircraft. Fiat Chrysler Automobiles (now known as Stellantis) is leading a Spearhead to produce a metal-free graphene automobile dashboard that could reduce manufacturing costs and lower fuel consumption. Another Spearhead, led by Varta Microinnovation, plans to advance a graphene–silicon anode for lithium-ion automotive batteries. Its goal is improving the lifetime of a composite that was developed in an earlier flagship phase to 1000 charge–discharge cycles.

The Graphene Flagship has already spun off a dozen companies. InBrain Neuroelectronics, formed by two flagship-partner research institutes funded by the Catalan government, is developing graphene-based implants for treatment of Parkinson’s, epilepsy, and other brain disorders. In March the company announced it had raised a total of €15 million from venture capital firms and the Spanish government. BeDimensional, an Italian spinoff, develops and produces graphene for the manufacturing and energy industries.

Shoes and concrete

Many low-tech applications for graphene, such as composite materials, have moved forward without flagship support. When mixed with rubber, graphene improves the grip and durability of tires. Shoes manufactured by the UK company Inov-8 improve trail runners’ purchase on slick rocks while also providing good cushioning. Researchers have found that concrete mixed with small amounts—typically 0.1%—of graphene flakes can improve the material’s structural strength by 30% and thereby reduce the need for structural steel reinforcement. Adding graphene also lowers the amount of concrete required for a job and reduces the substantial carbon footprint of cement and concrete.

James Baker, who leads the University of Manchester’s Graphene Engineering Innovation Centre, says the university teamed with a construction company in May to pour a local gym floor made with so-called Concretene. “Builders who have been in the business for 40 years say it’s the best concrete floor they’ve ever seen,” he says.

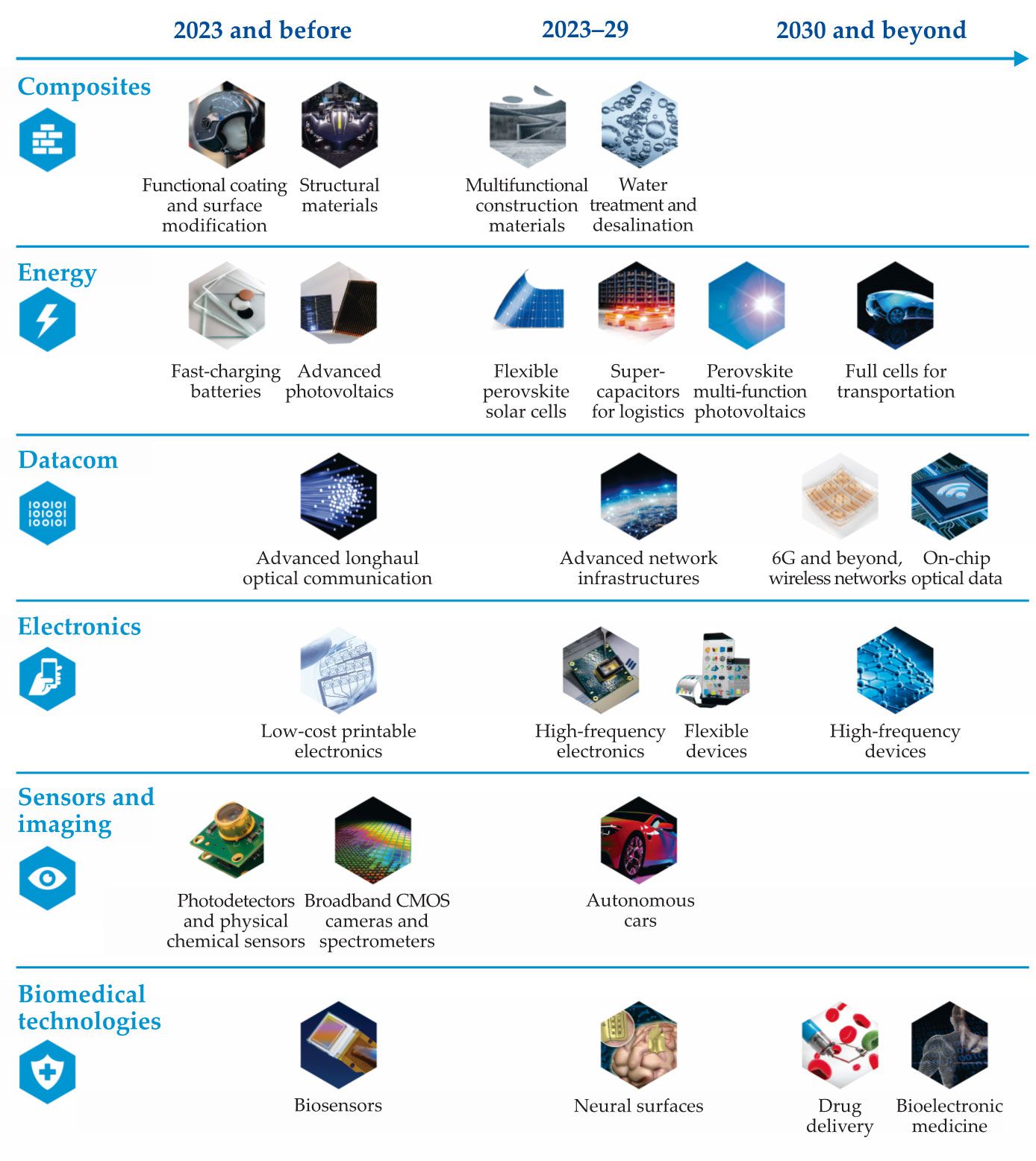

The Graphene Flagship’s anticipated timeline for the commercialization of various graphene applications and products. (Courtesy of Graphene Flagship.)

Despite Brexit, UK members will remain in the flagship through its conclusion. Manchester, where Andre Geim and Kostantin Novoselov discovered how to make graphene in 2004 (see Physics Today, December 2010, page 14

Baker says the Graphene Flagship has brought together a much larger range of universities and industry participants than Manchester could have done on its own. “With €1 billion, the flagship has got critical mass, and other activities, like toxicology, health and safety, and standards, things that are best to do collectively. It’s been a key part in accelerating the whole language and supply chain around graphene, and that’s critical if you’re commercializing.”

Terrance Barkan, executive director of the Graphene Council, a trade association based in North Carolina but with an international membership, credits the flagship for elevating awareness of the material in Europe and providing sustained support for academic R&D. “The strength of the Graphene Flagship has been providing the EU and Europe with a unified strategy in developing an industry around these advanced materials. Whereas in the US, everybody is left to their own devices,” he says. But while the flagship has performed well on supporting innovation, “the commercial conversion hasn’t been as big a success as one would expect.” And dependence on the subsidies the flagship has provided to industry could result in products that don’t sell, he says.

A tipping point

Regardless of how its performance is judged, the Graphene Flagship isn’t expected to be extended beyond its 10-year term. “What happens after the flagship ends is that many of our activities will continue with the support of Horizon Europe,” says Chalmers’s Kinaret, referring to the EU’s €95.5 billion wide-ranging R&D program that runs through 2027. “And some will have reached the level of maturity that they no longer require support of the European taxpayer.”

Rather than duplicating the flagship, Barkan says, the US should drive demand by easing regulatory requirements that currently need approval from the Environmental Protection Agency for each new application of graphene. The US could also boost the growth of such products as graphene-embedded concrete by establishing low-carbon-emission requirements for road-building materials.

Forecasts for graphene demand vary widely, but there is little doubt that the market will rapidly expand. Still, graphene is being held back by a lack of application-oriented standards and uniform quality metrics. Part of the flagship program has been devoted to developing such standards, but adoption requires approval from multiple national and international standards bodies, a process that can take years. “The problem is, industry doesn’t have years to wait,” says Barkan, whose organization also works to accelerate the adoption of standards.

“Graphene is approaching a tipping point,” says Baker, who expects growth to occur in “fast and slow lane” applications. The fast category comprises such uses as rubber, plastics, and carbon fiber, where alterations to the manufacturing process aren’t necessary and government approval isn’t required. Water-purification membranes and biomedical applications will move more slowly, he explains, because of the need for regulatory approval and certification processes.

More about the authors

David Kramer, dkramer@aip.org