Electrification of cars and trucks likely won’t disrupt the grid

DOI: 10.1063/PT.3.4978

Matteo Muratori, who leads a research team at the National Renewable Energy Laboratory, is frustrated at social media posts warning that the rapid growth in electric vehicles will break the US electricity grid. The increase in electricity demand, or load, that will come as the US transportation system transforms to electric drive won’t be any different from what occurred when air conditioning began to be widely adopted, he says.

“Utilities are excited. Selling more electricity is their business,” Muratori says. “We build new industrial facilities, new hospitals, and new schools, and they make sure the electricity is there to support those needs.” To balance supply with demand, the grid evolves on a daily basis as new load is added.

Michael Kintner-Meyer, an electrical engineer who leads mobility research at Pacific Northwest National Laboratory, agrees. “The lights will not go out,” he says, and there isn’t a tipping point that will overwhelm the grid.

There’s no doubt that substantial growth in load will come from a wholesale conversion to electric vehicles (EVs) as the US, and the rest of the world, decarbonizes its transportation systems. Daniel Bowermaster, head of the electric vehicle research program at the Electric Power Research Institute, says US electricity demand would suddenly leap 25% if the nation’s entire 290 million cars and trucks were converted to electric drive.

Muratori says EVs, which currently consume 0.2% of the grid’s energy, will grow to 24% of demand when transportation becomes highly electrified. But Muratori, Bowermaster, and other experts agree that the shift to electric drive will be gradual and will provide utility and regulatory planners plenty of time to adapt.

President Biden has set a goal for EVs to make up half of all new vehicle sales by 2030. In February the administration unveiled its $5 billion, five-year plan for the National Electric Vehicle Infrastructure (NEVI) Formula Program. It will consist of 500 000 EV charging stations along interstate and other highways that are “designated alternative fuel vehicle corridors.” NEVI is funded through the Bipartisan Infrastructure Law (BIL), which was enacted in November 2021.

States, which have to contribute 20% of NEVI infrastructure costs, are to submit their plans this summer on how they will spend the funding. The money is to be allocated under a formula based on the amount of funding that the states receive from the Federal Highway Administration.

The BIL also provides for a second, $2.5 billion competitive grant program to further increase EV charging access in locations throughout the country, particularly in rural and underserved communities. Guidelines for that program will be announced later this year, according to the Departments of Energy and Transportation, which are jointly administering NEVI.

In a 2020 DOE-commissioned study of the Western Interconnection, one of the three power grids in the US, the Pacific Northwest National Laboratory found that power demand from EVs could be accommodated through 2028. But Kintner-Meyer notes that data for the report were gathered in 2018, when only California projected an appreciable number of EVs. Demand from the other western states for EVs was “in the noise,” he says.

Since 2018, planners at suppliers of bulk power have become much more attuned to the implications of an EV transition, Kintner-Meyer says. “The whole industry is aware new load is coming.”

Rapid charging stations servicing dozens of cars and trucks along busy highways will require megawatts of power and direct connections to the high-voltage transmission system.

ISTOCK.COM/JEFF_HU

California’s ambitions

California is far and away the leader in the adoption of EVs, and state resources devoted to the EV transition dwarf the federal effort. Hannon Rasool, a deputy director with the California Energy Commission (CEC), says spending, including incentives for purchasing EVs, is expected to total $10 billion over the next five to six years. Even before the promise of federal funds, the state had plans to install 250 000 EV chargers, including 10 000 DC fast chargers, by 2025.

NEVI funds will pay for some of those. According to the CEC’s 2021–2023 Investment Update for the Clean Transportation Program, for the state to reduce greenhouse gases, oil dependence, and air pollution, nearly 1.2 million public and private charging stations will be needed to support the roughly 8 million passenger EVs expected on Golden State roads by 2030. An additional 157 000 chargers will be needed to support the 180 000 medium- and heavy-duty vehicles anticipated on the same time scale.

Rasool says the CEC has been planning for the additional energy supply, in conjunction with the California Public Utility Commission, other agencies, and the California Independent System Operator, which manages the state’s power grid. “Resiliency and reliability are really important to us,” he says. “EVs create resiliency that combustion vehicles can’t.”

Modeling predicts that California will need 16% more electricity by 2030. Half of that will be for EVs, says Quentin Gee, a supervisor in CEC’s energy assessments division. “We have a good sense on where the load is going to go, and a lot of EVs will start in urban regions,” he says. “But more planning is needed to provide a more accurate geographical picture at the local level.”

Electricity generation is one part of the electricity grid; the other two components are the high-voltage transmission and low-voltage distribution systems. The BIL stipulates that each NEVI station have a minimum capacity of 600 kW, enough to power four 150 kW DC fast-charging points. Fast chargers can recharge a battery to 80% in as little as 20 minutes. The last 20% can take as long as the first 80%. Level 2 chargers used for home and office require several hours to complete charging.

But charging hubs along interstate highways eventually will be expanded to accommodate perhaps 50 cars and 10 18-wheel trucks at a time, says Kintner-Meyer. That load might total 30 MW, well beyond the capacity of the low-voltage distribution system. That will require a direct connection to the transmission system, an expensive proposition that involves transformer substations and permitting, he says.

Distribution systems also will need upgrades to handle the extra load from charging EVs at homes, park-and-ride lots, and offices. “It’s standard business for distribution planners to lay out electric infrastructure for a new subdivision with 100 homes,” says Kintner-Meyer, “But now we have to consider how many EVs we will have in the next five years, when will they come, where will they charge, and how will they be charged.”

In exchange for monopoly rights, utilities are obligated under both common law and state statutes to deliver power to new EV charging stations, just as they do to a new shopping center, industrial facility, or hospital, for example. Their costs could be recovered through a general rate increase approved by the state public utility commission, says Rasool. The new EV charging station owner might be billed for some parts of the power delivery infrastructure. Often utilities simply recoup the costs of upgrades from the sale of the additional power that is delivered.

Demand-side management

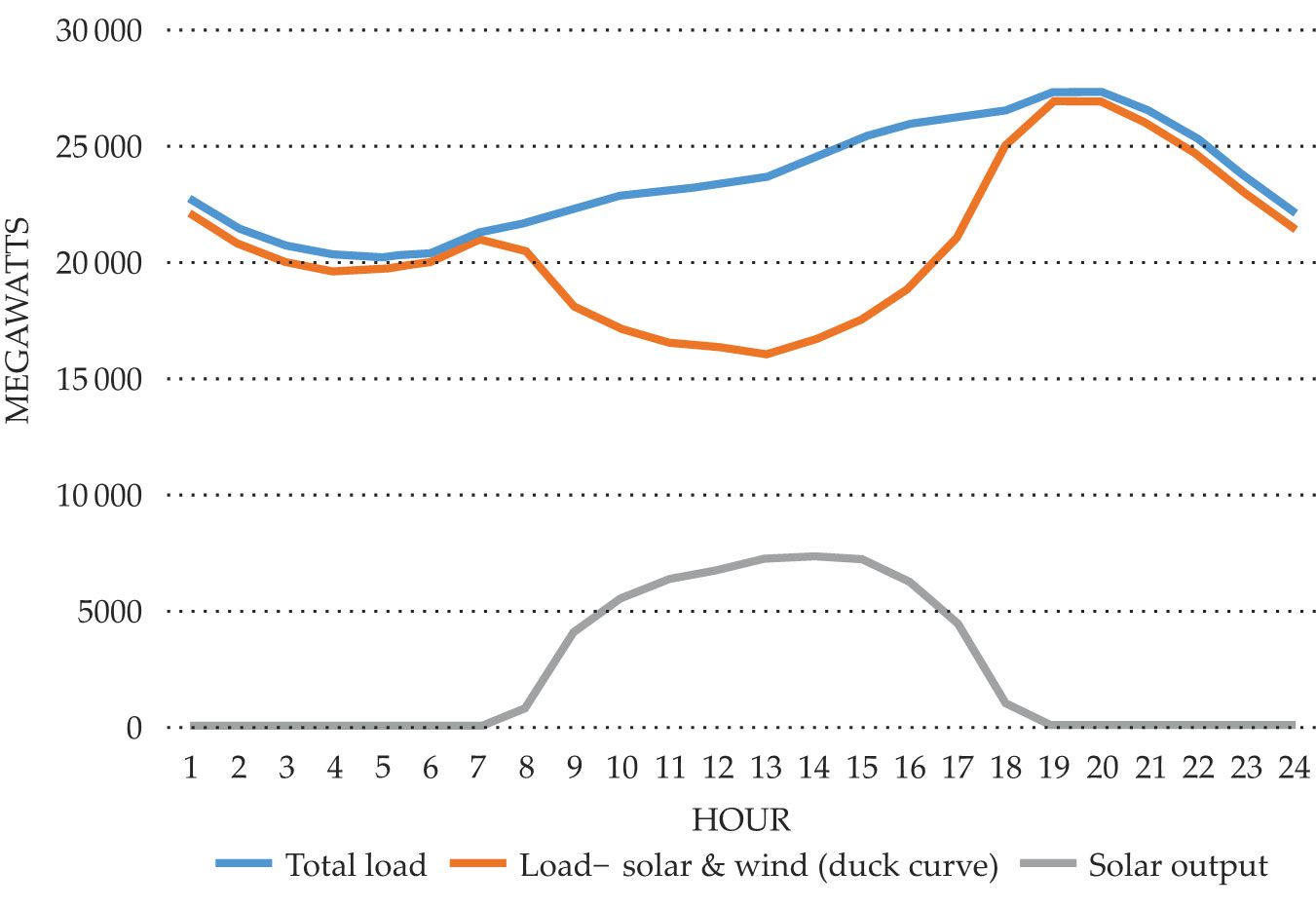

Lacking any incentives to do otherwise, EV owners would likely plug their cars in when they get home each evening, just as demand for grid power peaks. In California especially, distributed solar generation drastically lowers electricity demand from the grid during daytime hours. Once the Sun goes down, utilities must rapidly switch on generation. The phenomenon is known as the duck curve (see the illustration on

“If you lay on top of the peaks the added load from EV charging, you run out of capacity earlier than if you move [the load],” Kintner-Meyer says. So-called smart charging can shift much of the load to off-peak times. Utilities have long used variable rate structures to incentivize consumers to move their power usage to lower-demand periods. “You can charge in the daytime if you want to and pay more or wait until the middle of the night and pay less,” says Muratori.

Since 80% of motorists drive 65 kilometers or less in a day, they may need to recharge only once or twice a week. Because the average US car is parked 96% of the time, there are plenty of off-peak hours in which to charge them. EVs, like most appliances, can easily be programmed to begin charging at an appointed hour. And, says Muratori, business models can be implemented to incentivize consumers and compensate them for using electricity during off-peak times.

Electrified long-haul trucks, delivery vans, and transit buses will have less flexibility on when to charge. Like a refrigerator that must run all day, those vehicles may require charging multiple times each day and may operate day and night.

The duck curve is the daily load pattern from natural gas power plants and other on-demand sources of electricity that occurs in states with large amounts of distributed solar energy. Electric vehicle charging in the evening will exacerbate the peak demand that already occurs after the Sun sets. These data are from California on 22 October 2016.

ARNOLDREINHOLD/CC BY-SA 4.0

“The concern is high-megawatt locations, such as a big fast-charging plaza or a fleet depot,” says Bowermaster, pointing to places in Los Angeles where there may be 10 or 20 warehouses that are planning to move to all-electric delivery fleets. “How long will it take to upgrade those circuits and at what cost?” he says.

“When you decide to buy a truck, you usually don’t think that you’ll have to wait two years for my distribution system to be ready to charge it,” says Muratori. “It’s really important to plan ahead. Adopting these vehicles must be done in coordination with utilities.”

Bowermaster is worried about timing. “Once the automotive supply chain gets going again, electric delivery vans and semitrucks are going to be coming off the assembly line far faster than the lead time for a substation,” he warns. Regulatory bodies are pondering the amount of leeway they will give to utilities to build “ahead of the load” in anticipation of the increased demand.

But electrifying trucks provides “a lot of bang for your buck when it comes to greenhouse gas emissions and local air pollution,” says Rasool. “We know that vehicle emissions impact low-income communities worse.” Drayage trucks, which travel a well-defined route, such as from a port to a warehouse, are excellent candidates for electrification. The CEC is seeking proposals from companies operating 40–50 of those trucks to subsidize the cost of converting them to electric drive.

How much of the new electricity load from EVs will be supplied by renewable sources will likely vary from state to state. Many, if not most, states have renewable energy standards mandating that their total generation must be from nonpolluting sources. California aims to be 60% carbon-free by 2030 and is nearly there already, says the CEC’s Gee. The state is targeting 2045 for full decarbonization of its power.

The electricity industry recognizes the need to retire fossil-fuel plants sooner than it had originally planned or to make further investments to clean them up with carbon capture and storage or the use of green natural gas, says Kintner-Meyer. “You need to keep the lights on,” he adds, and gas turbines do provide a flexibility that wind and solar can’t.

More about the authors

David Kramer, dkramer@aip.org