DOE medical isotope campaign nears completion

DOI: 10.1063/PT.3.4938

A nearly three-decade-long quest to end US exports of weapons-grade uranium has surmounted one of the last remaining hurdles. On 20 December two federal agencies announced that highly enriched uranium (HEU) no longer needs to be shipped to facilities abroad for sufficient molybdenum-99 to be produced to meet US medical demand. (Weapons-grade uranium is enriched to more than 93% in 235U; HEU contains 20% or more 235U.)

Weeks earlier, the Department of Energy’s National Nuclear Security Administration (NNSA) announced the last in a series of grants made during a nine-year-long campaign to build a domestic 99Mo industry from scratch. Despite consuming roughly half of the world’s 99Mo, from 1989 to 2018 the US lacked its own production source. Molybdenum-99 is the parent of the medical isotope technetium-99m, which is used in about 40 000 US diagnostic procedures daily.

A $13 million award to Niowave, of Lansing, Michigan, followed grants made earlier last year of $35 million to SHINE Technologies in Janesville, Wisconsin, and $37 million to NorthStar Medical Radioisotopes in Beloit, Wisconsin. Joanie Dix, the deputy director of the NNSA’s Office of Conversion, says the agency has informed lawmakers that it won’t need further appropriations to subsidize domestic 99Mo production. Congress had ordered the funding program in the American Medical Isotopes Production Act of 2012.

Cross purposes

For decades, DOE has been torn between its conflicting missions of halting international commerce in weapons-grade HEU and ensuring an adequate US 99Mo supply. Over that period, the agency has cajoled and helped operators of foreign research reactors to convert their US-origin HEU fuel to low-enriched uranium (LEU), which is enriched to less than 20% in 235U and isn’t considered a proliferation concern (see Physics Today, April 2016, page 28

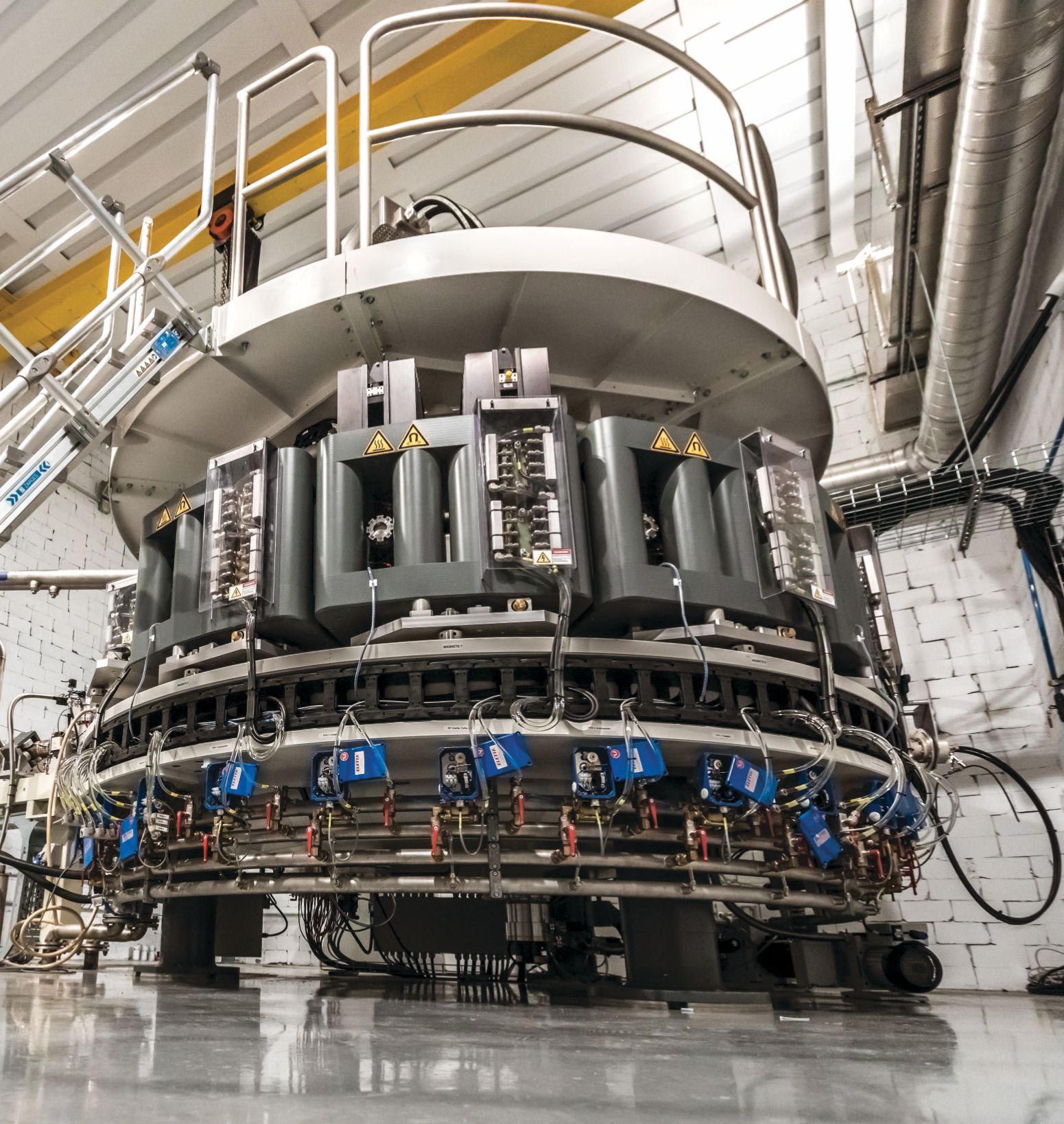

An electron-beam accelerator that NorthStar Medical Radioisotopes will use to manufacture molybdenum-99 by knocking off a neutron from 100Mo. The company expects to begin producing 99Mo using that method early in 2023; it has been making the isotope by a different method since 2018.

NORTHSTAR MEDICAL RADIOISOTOPES

Yet at the same time, the NNSA routinely supplied HEU for fabrication into 99Mo targets by a Canadian research reactor that had met half of US demand until its 2018 shutdown. Until last year, the agency shipped HEU for the manufacture of targets by two European 99Mo producers, Curium, headquartered in London and Paris, and Belgium’s Institute for Radioelements. Both companies bombard the targets with neutrons in reactors located in Belgium, the Netherlands, France, the Czech Republic, and Poland.

The last license for a shipment of weapons-grade uranium for use in targets was issued to the Institute for Radioelements by the US Nuclear Regulatory Commission in April 2020, with an expiration date of December 2021. That license authorized the export of 4.5 kg to the French company Framatome, which fabricates the targets. For security reasons, actual shipment dates are not made public.

The 20 December 99Mo announcement by Energy secretary Jennifer Granholm and Health and Human Services secretary Xavier Becerra won’t end all HEU shipments. The NNSA will continue to supply weapons-grade HEU to fuel two European research reactors: Belgian Reactor 2 and the Institut Laue–Langevin research reactor in Grenoble, France. SCK CEN, which operates Belgian Reactor 2, has pledged to convert the reactor to LEU fuel by 2026. The reactor consumes 20–30 kg of HEU annually, says Alan Kuperman, coordinator of the Nuclear Proliferation Prevention Project at the University of Texas at Austin.

But the Institut Laue–Langevin isn’t scheduled to switch to LEU until 2031. The Nuclear Regulatory Commission is now considering the institute’s request for 130 kg of HEU, which the French facility has told the NNSA will meet its needs through 2026. Kuperman, however, says the requested amount should be sufficient through 2028. The NNSA is likely to provide at least one more fuel shipment each to the Belgian and French reactors, he adds.

The drive to phase out HEU shipments abroad dates to a directive in the Energy Policy Act of 1992. But a provision allowed exports needed for 99Mo targets to continue until a supply of the isotope sufficient for US needs could be made with LEU targets alone.

“The secretaries’ bold action puts one dangerous nuclear genie back in the bottle and brings to fruition more than three decades of efforts,” Kuperman says. Those efforts included the Reduced Enrichment for Research and Test Reactors Program at Argonne National Laboratory, which designed LEU fuels compatible for reactor cores originally fueled by HEU. R&D continues at Argonne and at other DOE labs to develop fuels for remaining HEU-fueled high-performance research reactors, four of which are in the US.

The domestic program

Since 2012, the NNSA has awarded a total of $256 million to seven aspiring US producers of 99Mo. The recipients must provide matching funding. The agency also provided $152 million to the national laboratories to provide nonproprietary technical support to any prospective domestic producer, including nonawardee companies (see “Competition heats up to produce medical radioisotope

Three of the NNSA’s earlier 99Mo awardees—GE Hitachi Nuclear Energy, General Atomics, and Northwest Medical Isotopes—abandoned their plans and returned portions of their awards. BWX Technologies, which received $9 million from the NNSA, continues its 99Mo development program, says a spokesperson.

The three 2021 grant recipients signed cooperative agreements with the NNSA requiring them to achieve specific production capacities by the end of 2023. SHINE and Niowave are each to have the capability of producing 1500 six-day curies per week. (A six-day curie is a measure of the remaining radioactivity of 99Mo six days after it leaves the processing facility. The isotope’s half-life is 66 hours.) NorthStar is expected to be capable of producing 3000 six-day curies weekly: 1500 by each of its two manufacturing methods.

The NNSA’s Dix says the three awardees should provide the US with the capacity to become self-sufficient in 99Mo, assuming stable demand for the isotope. That demand is currently around 4000 six-day curies per week, according to the NNSA. How much each company will actually sell will be determined by the international marketplace. In addition to the Institute for Radioelements and Curium, major global suppliers are located in South Africa and Australia.

The NNSA funding is disbursed in tranches once the companies meet milestones spelled out in their cooperative agreements.

Today, NorthStar remains the only domestic producer of 99Mo. Since 2018, it has manufactured 99Mo by neutron capture, irradiating targets containing the plentiful 98Mo isotope with neutrons from the University of Missouri Research Reactor. According to James Harvey, NorthStar’s senior vice president and chief science officer, the company already has the capacity to meet 20% of US demand for the isotope.

Ironically, the University of Missouri facility is one of two remaining US university research reactors to be fueled with HEU. The university has promised to convert it when a compatible LEU fuel is developed.

NorthStar, Niowave, and SHINE all propose to use accelerators to produce 99Mo, each through a different process. Beginning next year, NorthStar plans to use electron-beam accelerators to spall, or knock off, a neutron from 100Mo. The Belgian producer IBA has already delivered two 40 MeV accelerators to Wisconsin, and the addition of another two that are on order will meet the NNSA’s required production capability, Harvey says. Besides doubling capacity, NorthStar’s dual production methods will provide the ability to ship isotopes seven days a week, he says.

For the past year, the company has been using feedstock enriched in the 98Mo isotope, which has allowed it to increase the size of its package, known as a 99mTc generator, to 20 curies, the maximum allowed by the Department of Transportation. Several companies, including Urenco, can supply enriched Mo, but there is no US source, Harvey says. NorthStar is awaiting approval from the Food and Drug Administration to use recycled Mo in its processes.

The president of Niowave, Mike Zamiara, says the company will use niobium-based superconducting accelerators of its own design to produce 99Mo from LEU in a noncritical reactor. The company was founded by a former employee of the National Superconducting Cyclotron Laboratory, now known as the Facility for Rare Isotope Beams, at Michigan State University. In Niowave’s process, electrons are fired at a liquid metal target, producing high-energy bremsstrahlung photons that strip neutrons from the liquid metal to fission LEU targets.

Zamiara says the $28 million total the company received from the NNSA will help it scale up operations. Niowave already produces the medical isotopes yttrium-90 and actinium-225, but with 99Mo, he says, “you’re dealing with kilocurie quantities and more. That’s a lot of uranium and a lot of radiochemistry processing” compared with the millicurie to curie volumes that are typical for 90Y and 225Ac.

SHINE’s process entails bombarding a uranium target with neutrons. Rather than using fission, the company produces neutrons by firing accelerated deuterons at a tritium target. The resulting fusion reaction yields high-energy neutrons that are slowed to thermal energies before entering an aqueous target containing LEU. SHINE’s CEO, Greg Piefer, says the NNSA support has enabled the company to accelerate construction of the four accelerators that will provide the required capacity. He expects to receive regulatory approval for operations to begin by mid 2023.

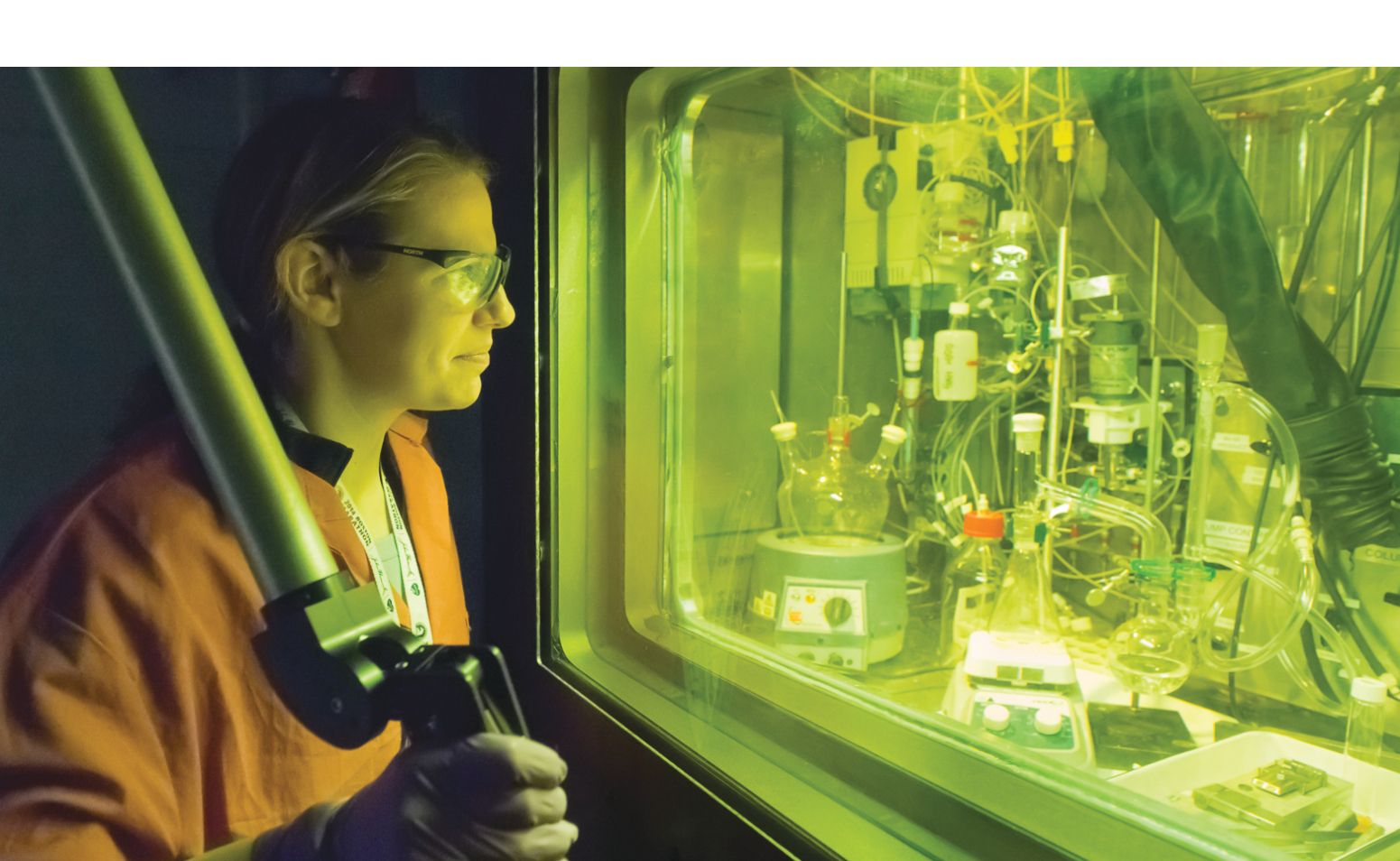

Amanda Youker, a chemist at Argonne National Laboratory, operates a remote manipulator arm in a radiation-shielded cell. The cell was used for the purification of molybdenum-99 in a demo of the production process that will be used by SHINE Technologies.

WES AGRESTA

SHINE has contracted with Ontario Power Generation for tritium, which the Canadian utility extracts during the recycling of heavy water from its reactors. Piefer says SHINE’s 99Mo operations will likely require less than 1% of the power producer’s annual output.

The American Medical Isotopes Production Act of 2012 included a provision for DOE to supply LEU from its stockpile to any US 99Mo producer that needs it, and to take back any radioactive waste that the companies are unable to dispose of commercially. Companies will be charged for the associated costs. The NNSA announced the first such agreement with SHINE on 6 January. Niowave’s process also requires LEU; NorthStar’s does not.

Essential or not?

Though the NNSA support accelerated NorthStar’s and SHINE’s 99Mo production plans, it wasn’t necessarily essential, their executives say. Harvey notes that NorthStar has been developing its processes since its formation in 2007. Niowave, however, probably wouldn’t have entered the business without government support, Zamiara admits. “I don’t think we would have gone this far, just because of the sheer magnitude of the 99Mo market.”

“If you look at the dollars that NorthStar and SHINE have gotten [totaling $102 million and $75 million, respectively], our program is dwarfed because we did come at this late,” Zamiara says. “We were scaling up our accelerator for multiple uses when we decided to apply for the second round of agreements. We felt we had a path and we could catch up with the others.”

Piefer, in turn, notes that the NNSA funding pales in comparison to the billions of dollars in subsidies he says have been provided to producers in Europe, Australia, and South Africa. Moreover, he adds, the Jules Horowitz Reactor, under construction in France, is funded by multiple European governments, and plans call for it to enter the 99Mo business when it’s completed later this decade.

Harvey dismisses objections that might be raised to the government subsidies. “This is a perfect example of a program that the federal government embarked on to solve a serious problem affecting health care, when the US was solely dependent on foreign sources.”

The NNSA’s Dix concurs. “Our program was meant to kick-start a commercial enterprise and then back out. This is certainly not one of those government programs that has no end.” She adds that some attrition was to be expected. “I don’t think there was an expectation that all the companies we started with would be those that reached the finish line.”

More about the authors

David Kramer, dkramer@aip.org