Capture alone isn’t sufficient to bottle up carbon dioxide

DOI: 10.1063/PT.3.5268

Billions of dollars in federal subsidies, combined with enhanced tax credits, have stimulated dozens of new carbon capture and storage (CCS) and direct air capture (DAC) projects in the US. But a severe bottleneck in the regulatory process for transport and storage is slowing progress toward meeting the goal of the Biden administration to reach net-zero emissions by 2050.

The 2021 bipartisan Infrastructure Investment and Jobs Act (IIJA) appropriated more than $10 billion in R&D and demonstration project funding over five years for CCS and DAC. (See Physics Today, January 2022, page 22

In May, the Environmental Protection Agency published a notice of proposed rulemaking that, if it becomes final, would establish CO2 emission limits on existing and new fossil-fuel power plants. That could stimulate further demand for CCS in the years ahead.

An April report from the Department of Energy says models suggest that achieving the US net-zero emissions goal will require capturing and storing 400–1800 million tons of CO2 per year by 2050. Today the US leads the world in capturing around 20 million tons annually, almost all of it from ethanol refining, hydrogen production, and natural-gas processing. Those sources provide concentrated, high-purity CO2 streams, costing as little as $20 per ton to capture, according to the International Energy Agency. Most of that gas is transported in supercritical form via pipelines to depleted oil reservoirs for use in enhanced oil recovery. Although the injected CO2 will stay locked up, the petroleum that it pushes out will eventually add to the atmospheric CO2 burden.

The Petra Nova plant in Thompsons, Texas, was the only US power plant to successfully capture carbon dioxide from postcombustion at a commercial scale. The CO2 was compressed and piped to an oil field for enhanced oil recovery. The system operated from 2017 until 2020, when low oil prices made capture uneconomic.

RM VM/WIKIMEDIA COMMONS/CC BY-SA 4.0

Carbon capture from industries with lower-purity CO2 streams and distributed process emissions—power, ammonia, cement, steelmaking, and other plants—will require improved project economics, the DOE report says. Lowering costs in those industries, which the International Energy Agency says range up to $120 per ton, could be accomplished through a combination of technology improvements, tighter regulations, and enhanced subsidies. In any case, widespread decarbonization of those industries isn’t likely to come before 2030, the DOE report says.

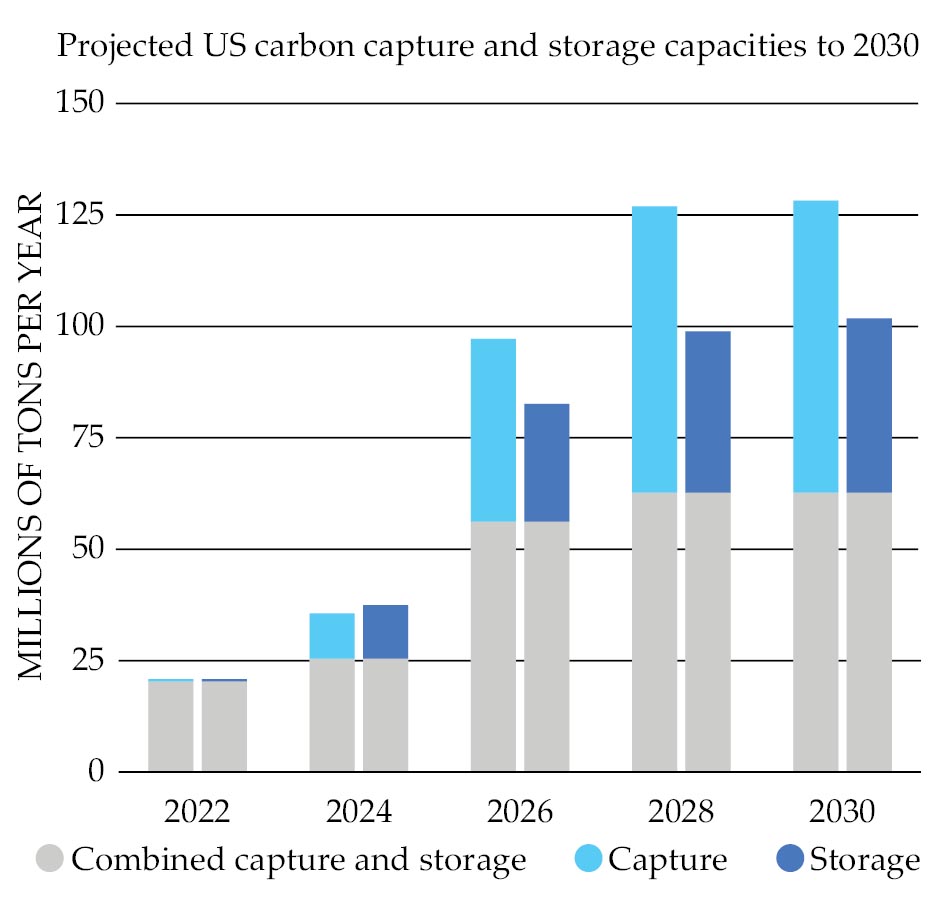

Carbon-capture projects in the US totaling around 140 million tons per year are expected to be in place by 2030, according to BloombergNEF. Yet as capture technologies are scaled up and deployed to collect millions of tons of CO2 annually, their success will be contingent on the more mundane tasks of building out today’s tiny CO2 storage and transport infrastructure. Public concerns about pipeline safety and possible leakage from underground storage have the potential to slow those deployments.

Credits and subsidies

On 17 May DOE announced awards totaling $251 million to 12 projects in seven states to expand the CO2 transportation and storage infrastructure. It’s the first tranche of the $2.5 billion that was appropriated over five years by the IIJA specifically for those purposes. Nine projects totaling $242 million will support new and expanded commercial carbon storage projects with capacities to store 50 million tons of CO2 or more. Three projects for a total of $9 million were selected to prepare detailed engineering design studies of proposed regional CO2 pipeline networks to carry captured gas from power plants, ethanol refineries, and other industrial operations either to permanent storage or to factories where it will be incorporated into long-lived products such as concrete.

In its May announcement, the department also solicited proposals for additional storage and transportation projects to be funded from the remaining $2.2 billion in dedicated IIJA funding.

Because capturing CO2 from ambient air is far more difficult than scrubbing it from concentrated point sources, larger tax credits are provided for DAC: $180 per ton if the CO2 is permanently stored and $130 per ton if the CO2 is utilized. The few commercial DAC plants in operation have costs well over $200 per ton.

An injection well in Mississippi was sponsored by the Department of Energy to test the effectiveness of injecting and storing carbon dioxide in a deep saline reservoir.

US GEOLOGICAL SURVEY

The IIJA provided $3.5 billion to help finance four regional DAC hubs. DOE expects to announce awards totaling $1.2 billion of that amount this summer.

In April the Occidental Petroleum subsidiary 1PointFive broke ground on a DAC plant in West Texas that aims to capture and store 500 000 tons of CO2 per year beginning in 2025. The company is currently seeking permits for 1.2 billion tons of geological storage capacity along the Gulf Coast. Plans call for building 70 similar plants around the globe by 2035, and more if further policy incentives are enacted.

The largest DAC project announced to date is CarbonCapture’s Project Bison, the initial stages of which the company hopes to begin operating late this year. The company says that by 2030 the modular plant will suck 5 million tons of CO2 per year from the air—the amount emitted by an average coal power plant—to be injected into a saline aquifer at its site in Wyoming.

A choke point

In addition to technology development and financing, the rate at which CCS and DAC projects are deployed will hinge on the EPA’s issuance of permits required for CO2 injection wells. To date, the EPA has been agonizingly slow to approve the so-called Class VI permits, critics say.

The US has sufficient geologic storage capacity for trillions of tons of CO2, enough to store the entirety of the nation’s emissions for hundreds of years, according to DOE. But the porous rock formations and deep saline aquifers that are ideal for permanent storage aren’t spread uniformly across the country, and each injection site must be carefully characterized to ensure that it can retain the CO2 for 10 000 years or more.

Today just two US facilities are capturing and permanently storing appreciable amounts of CO2 in a geological formation: the Decatur, Illinois, ethanol refinery operated by Archer Daniels Midland and the Red Trail Energy ethanol plant in North Dakota. Archer Daniels Midland injects the captured gas into the only two CO2 injection wells that are permitted by the EPA. Those Class VI permits are distinct from permit types that are issued for oil and gas drilling, and hazardous and oil and gas drilling waste disposal.

Class VI permit applications are piling up fast at the EPA. In June 2022 there were 14 in the queue. “A few weeks ago, there were 75, and when I checked this morning, there were 87,” said Danny Broberg, associate director of the Bipartisan Policy Center, on 25 May. “We need to significantly scale up how we can do CO2 injection without sacrificing environmental principles.”

“The stark reality is that any chance of meeting our net-zero emission goals by 2050 is going to require significant carbon capture build-out in this country,” says Jeremy Harrell, chief strategy officer of ClearPath, a Washington, DC, advocacy group. “We need fundamental permit reform to reduce the sheer amount of time it takes to permit a Class VI site.”

The EPA’s review of the Archer Daniels Midland permit applications took six years. In an October 2022 report to Congress, the EPA said it expects to process the applications within two years of their submission. But the agency cautioned that the exact time frame depends on the quality and quantity of site-specific data submitted, the amount of time the applicant takes to respond to requests for additional information, and the number and complexity of public comments received on the draft permit.

Jessie Stolark, executive director of the advocacy group Carbon Capture Coalition, says the EPA has made some progress in the year since passage of the IIJA, which provided the agency $25 million to bolster the permit review process. “We do know that standing up and staffing a regulatory program of this nature and complexity takes time, including addressing critical staffing needs at the agency,” she adds.

Several states have asked the EPA to delegate the Class VI well-permitting process to them to accelerate the approval process. Wyoming and North Dakota were granted such authority, known as primacy, during the Trump administration. Four other states have applied for Class VI primacy, but none have yet been approved by the current administration. The IIJA provided $50 million to help states establish Class VI primacy programs. Not every state is expected to apply; unfavorable storage geology exists in parts of the Southeast, for example, notes Harrell.

The EPA announced in April its intention to delegate Class VI authority to Louisiana. That announcement came soon after Senator Bill Cassidy (R-LA) threatened to hold up confirmation of Biden’s EPA nominees. ClearPath estimates that 6 million tons of CO2 per year could be locked up if Louisiana’s 10 pending Class VI permits are approved. CF Industries, for example, has plans to capture 2 million tons of CO2 each year from its ammonia plant, transporting it through an existing pipeline for storage beneath an injection site owned by ExxonMobil.

Carbon dioxide captured in the US will soon outstrip the capacity to store it, according to projections from the International Energy Agency. The plot shows all operating and planned CO2 capture, transport, storage, and utilization projects commissioned since the 1970s that have an announced capacity of more than 100 000 tons per year, or 1000 tons per year for direct-air-capture facilities. (Based on ClearPath’s analysis of the National Carbon Sequestration Database and Princeton University’s Net-Zero America project.)

In 2022, Red Trail Energy began injecting about 500 tons of CO2 per day more than a mile below the surface in North Dakota, becoming the first to operate a Class VI well approved under a primacy agreement. The state approved the permit in nine months. A second Class VI permit, to store CO2 that is to be captured from a coal power plant owned by the electric cooperative Minnkota, is nearing approval by the state.

North Dakota was able to act quickly on permits because the oil and gas industry had already well characterized the state’s geology, says Harrell. That should also apply for Texas, which submitted its primacy application in December 2022. Arizona and West Virginia also have primacy applications pending.

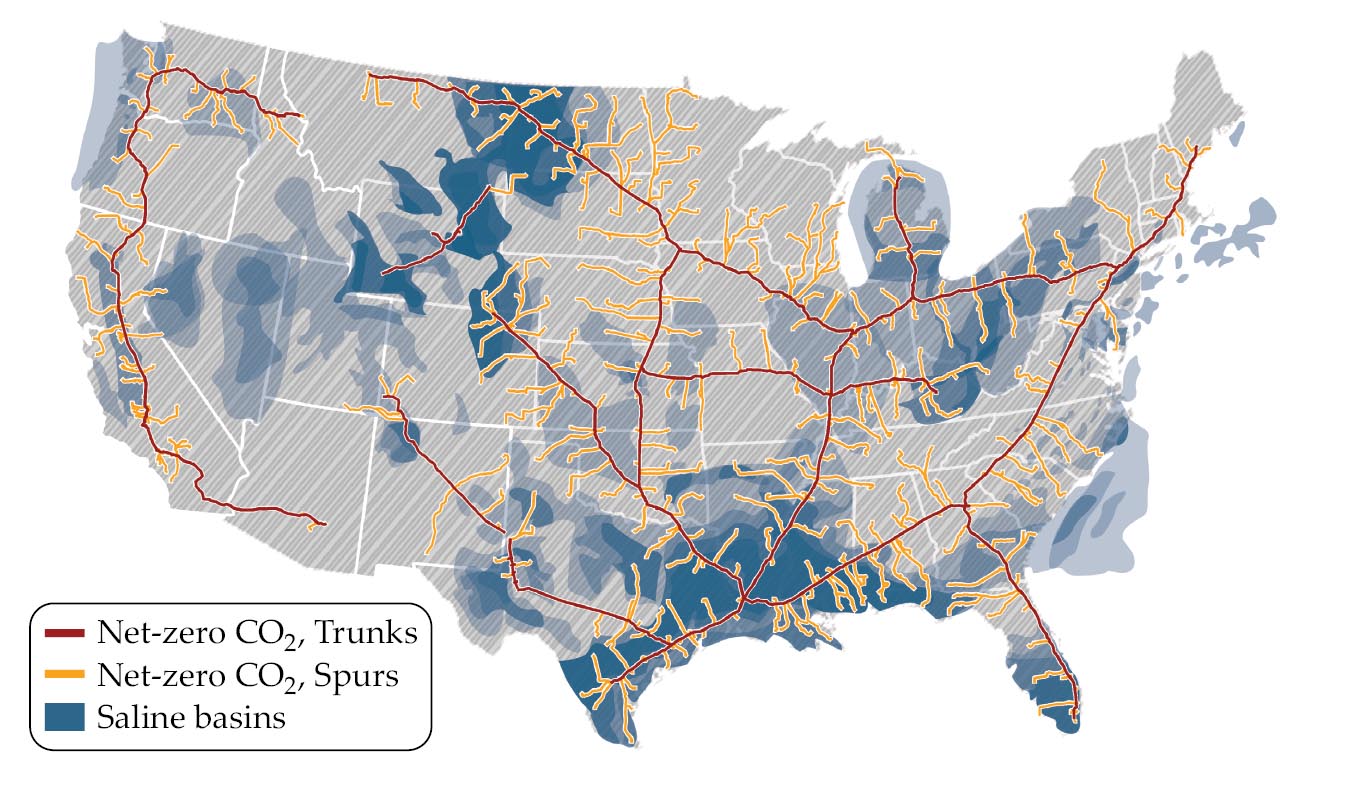

Transport

Virtually all of the 8050 km of pipeline built for CO2 transportation has been for supplying oil fields that have enhanced oil recovery operations. One scenario modeled by the advocacy group Great Plains Institute shows that moving 300 million tons of CO2 per year from emissions sources in the Midwest, South, and Great Plains states to deep underground storage sites would require around 46 700 km of pipelines. But many net-zero modeling analyses say the US will require a gigaton of storage by 2050. ClearPath estimates that would require a network of more than 100 000 km.

At least two companies are proposing overlapping pipelines across Midwestern states to collect CO2 from existing ethanol and fertilizer plants for injection in Illinois or North Dakota. Navigator CO2 Ventures, based in Omaha, Nebraska, proposes to build a 2000 km interstate pipeline network to transport up to 15 million tons annually from more than 30 ethanol and fertilizer manufacturers across five Midwestern states. Summit Carbon Solutions plans 3200 km of pipeline to gather and store CO2 from more than 30 ethanol plants in the same region.

New pipelines will be required to accommodate the volumes of carbon dioxide needing to be captured and stored if the US is to meet the goal of the Biden administration to attain net-zero emissions by 2050. Shown here is one illustrative network from the nonprofit advocacy group ClearPath.

The IIJA established a financing mechanism within DOE to provide flexible, low-interest grants and loans to cover a portion of the cost of common-carrier CO2 transport infrastructure development, lowering the risks for private-sector investment. The act allocates $2.1 billion over five years for those purposes.

Currently no federal body has regulatory jurisdiction over the siting of interstate CO2 pipelines. If authorized by Congress, the Federal Energy Regulatory Commission, which regulates interstate fossil fuel pipelines, or the Surface Transportation Board, which regulates freight rail, could be equipped for the role. But many large emitting states, including Texas and Louisiana, could transport from the emitting site to storage without having to cross state lines, Harrell notes.

The Department of Transportation’s Pipeline and Hazardous Materials Safety Administration regulates CO2 pipeline safety. It continues to update its regulations in the wake of a 2020 rupture of a CO2 pipeline owned by Denbury Gulf Coast Pipelines in Mississippi. Although no one was injured, local authorities had to evacuate some nearby residents. Heavier than air, CO2 disperses close to the ground and is an asphyxiant when concentrated.

More about the authors

David Kramer, dkramer@aip.org