Big changes may loom for small business research program

DOI: 10.1063/1.3027980

Every year, as the budget and appropriations process plays out, the White House and Congress haggle over their priorities for myriad federal R&D programs. But one of the biggest of those programs gets an automatic raise. Now in its 26th year, the Small Business Innovation Research program will distribute about $2 billion in grants this year to US small businesses that propose to meet the government’s technology needs, and hopefully commercialize as well. Taken together, the SBIR budgets of the 11 participating federal agencies are bigger than the total R&D portfolios of all but six of them.

But the SBIR program operates like an entitlement program, certain to grow steadily if slowly as federal spending for R&D inches up each year. No explicit intervention or approval from the president or lawmakers is necessary; the SBIR funding mechanism skims 2.5% off the participants’ annual outlays for all research that is not performed in-house. The monies are doled out in grants to hundreds of businesses that each must have fewer than 500 employees to qualify. Each agency administers its own SBIR program and reviews the proposals that it invites through periodic solicitations that set forth the agency’s technological needs.

This year, however, lawmakers were required to act. The SBIR statute is due to expire in a few months, and Congress is considering legislation that could dramatically reshape the program and expand its size by one-third or more in the next decade. That would run counter to the findings of a comprehensive review completed recently by the National Research Council (NRC); according to that study, the program is meeting its objectives and should essentially be left alone. But with so much money at stake and so few other sources of early-stage technology financing, the biotechnology industry has been looking to tap into SBIR funding.

A bill passed by the House of Representatives in April largely reflects biotech’s wishes, while a measure approved by the Senate Committee on Small Business and Entrepreneurship in July would follow the NRC course, which favors the sort of less-focused small technology companies that have captured the bulk of SBIR awards. Committee chairman John Kerry (D-MA) failed to gain a full Senate vote on the measure before adjournment in October, but stopgap legislation will keep the SBIR program going through 20 March. Kerry said in a statement that after the election he will push for the Senate bill’s approval to “come to a consensus without partisan objections.” He added, “This is a priority.” To avoid the chaos that will result if the program authority lapses, the new Congress that convenes in January will have to act in record time to move both bills through the legislative process again and, more important, reconcile legislators’ differences into a compromise bill. Given the disparities in direction taken by the House and Senate chambers, the final outcome is anybody’s guess.

Repeat winners

More than 6000 SBIR grants were awarded in 2005, the most recent year for which totals are available. One-third of the grants in a typical year go to first-time winners. Among the 17 000 small businesses that have won grants over the program’s lifetime, some have amassed hundreds. Creare Inc in Hanover, New Hampshire, has received more than 600 awards from multiple agencies since the SBIR program debuted in 1983, says president and principal engineer James Barry. Founded in 1961 to perform R&D for industrial and government clients, the 115-employee Creare has a business model that fits the SBIR mold of taking basic research through to working technology, he says. SBIR grants have paid for development of one-off technologies for federal customers, such as a cryocooler for instruments installed aboard the Hubble Space Telescope and specialized pumps for the Mars Science Laboratory rover scheduled for launch next year. Creare says it can trace $640 million of its own revenues, those of numerous spinoff companies it has formed, and those of its licensees to the products that resulted from technologies it developed with SBIR funds or from additional non-SBIR government R&D funding for the SBIR projects.

Another big SBIR winner, Physical Sciences Inc in Andover, Massachusetts, has grabbed $120 million in grants since 1983. The resulting products have included specialized instrumentation for the Department of Energy’s national laboratories, devices for retinal scanning, and environmental monitoring equipment. Robert Weiss, the company’s executive vice president for corporate business development, says the technologies have generated revenues in excess of $300 million for the 200-employee company, its spinoffs, and licensees. Over the years, Weiss says, the SBIR program has evolved from one that was “wide open for innovation’s sake” to one that is now “80% driven by the specialized procurement needs” of the sponsoring agency. The exceptions among the large SBIR agencies are NSF, which has no technology needs of its own and judges SBIR grant success in terms of “real or imagined commercial outcomes,” he says, and the National Institutes of Health, where the customer is most often a drug or medical device manufacturer.

Venture capital at issue

A major point of contention in the SBIR reauthorization process is whether to lift the prohibition on participation by small businesses that are majority owned by venture-capital firms. The House bill would do away with the exclusion, while the Senate’s would permit a limited number of awards to majority-venture-capital-owned firms, capped at 18% of SBIR funds awarded by NIH and 8% of SBIR monies distributed by all other agencies.

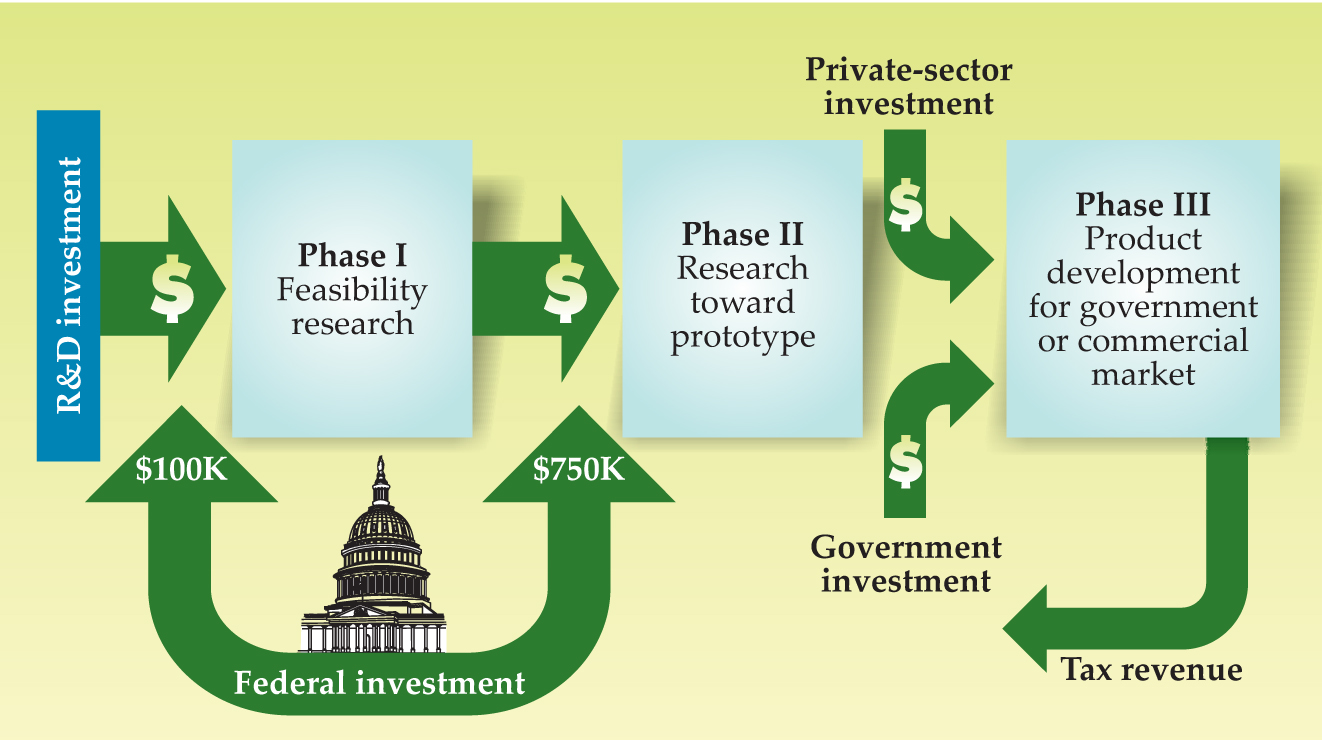

The House bill also caters to venture-backed small businesses in eliminating the current requirement for companies to obtain a feasibility study, or phase-one grant, before they are eligible to apply for a more lucrative phase-two grant, which pays for technology development (see the figure on page 22). And the House would triple maximum award sizes, from the current $100 000 for phase one to $300 000, and from $750 000 to $2.2 million for phase-two grants. The Senate bill would increase the caps more modestly, to $150 000 for phase one and $1 million for phase two. In actuality, though, maximums are only guidelines, and agencies are free to exceed those amounts. NIH has regularly topped them in awarding 91 phase-two grants of $2 million or more through 2005, according to the NRC report. The Department of Defense, home to the largest SBIR program, made 28 awards exceeding the $2 million mark between 1993 and 2005.

Small Business Innovation Research program schematic. Federal grants fund phases one and two. Phase-three resources are expected to come from private investment, and federal, state, and local funding.

NATIONAL RESEARCH COUNCIL

Some observers fear that the changes proposed in the House will lead to fewer, larger grants going to companies that have already obtained venture-capital backing for their technologies and are beyond the early stage of the commercialization process that the SBIR program was meant to address. Fewer grants means that fewer technologies will be developed to meet SBIR agencies’ needs and ultimately enter the commercial market.

Jere Glover, executive director of the Small Business Technology Council, says the SBIR program was meant to help as many companies and technologies as possible, including those with inventions that won’t pan out. “It’s remarkable how many technologies it has taken to the next level; it’s literally in the thousands,” he says. Without additional funding, the SBTC says, the tripling of award sizes called for in the House bill could shrink the number of awards by 60% for a program that is already highly competitive and typically funds only about 10% of the proposals that are submitted. Bypassing phase-one grants could even open the door to congressional earmarking of SBIR monies, Glover warns. “What has saved the program from scandal is that it is staged,” he says, which prevents lobbyists and members of congress from getting their hands on the money. The NRC review says that eliminating the phase-one grant “is neither necessary [n]or appropriate.”

Biotech wants in on SBIR

Barry and Weiss support the Senate measure and warn that the unfettered access by venture-capital-controlled companies as provided in the House bill will crowd out small firms. Weiss argues that the right time for venture-capital investments is after the SBIR-supported development has occurred.

But Ron Cohen, CEO of biotech firm Acorda Therapeutics, counters that venture-capital firms usually target investment in the product that is furthest on the path to commercialization, not a company’s technology portfolio. Thus while the company was still privately held, the $160 million in venture capital that Acorda attracted was narrowly focused on his lead product, a drug for treating multiple sclerosis. At the time, very little of the venture-capital funding was available for the company to develop two other products in the same family that remained in the preclinical stage.

Cohen, a physician, started the company in his bedroom. He credits the “several hundred thousand dollars” in SBIR awards he received with helping him advance his technology to the proof-of-principle stage. Far from discouraging venture-capital investment, Cohen says the SBIR program should welcome the stamp of approval that such investment bestows on fledgling technology companies.

More about the authors

David Kramer, dkramer@aip.org