ARPA–E can’t reach the promised land alone

DOI: 10.1063/PT.3.4613

The Advanced Research Projects Agency–Energy (ARPA–E), the 10-year-old Department of Energy program designed to foster high-risk clean-energy technologies, has had limited success in moving them toward commercialization, according to a recently published study. But ARPA–E managers, former program officials, and even the lead author of the study agree that the program is performing as it was intended in advancing potentially game-changing solutions for decarbonizing energy. Additional government programs and market incentives are needed, they say, to attract the investments that will bring those innovations to market.

Anna Goldstein of the University of Massachusetts Amherst and colleagues compared the success of 25 startups, all part of the initial 2010 cohort of 60 ARPA–E awardees, to 1262 other cleantech startups of the same age. The researchers used acquisitions by other companies, initial public offerings, survival through 2019, and the amount of venture capital (VC) raised through 2017 as indicators of successful business outcomes. They found that the ARPA–E startups fared no better than the clean-energy startups that didn’t apply for ARPA–E grants. Goldstein and her group published their analysis in Nature Energy on 14 September.

The comparison set comprised three groups: startups that had been rejected for ARPA–E grants, ones that had received grants in 2010 from DOE’s Office of Energy Efficiency and Renewable Energy (EERE), and startups that didn’t apply to ARPA–E or receive EERE funds. The authors said that of those, only the group of rejected ARPA-E applicants had worse business outcomes than the ARPA–E sponsored startups. No significant differences were identified between the success rates of the ARPA–E awardees and those of the EERE awardees. Nor did measures of success differ from those of the “other” group.

The findings “suggest that ARPA–E was not able to fully address the ‘valley of death’ for cleantech startups within 10–15 years after founding,” the paper states. The “valley of death” is a widely used term for the difficulty of obtaining the investment required to move an innovative technology from development to full-scale demonstration and commercialization.

The report concludes, however, that the ARPA–E startups showed a high degree of innovation by obtaining significantly more patents than any of the other groups. “They are patenting at twice the rate after their award, even accounting for other factors that we know influence the patenting rate. That’s what I see as the important finding,” Goldstein says.

Failure is an option

Patterned after the successful Defense Advanced Research Projects Agency, ARPA–E was created in 2007 legislation to support high-risk technologies that could greatly reduce greenhouse gas emissions. The new agency was initially funded through the American Recovery and Reinvestment Act of 2009, and its first awardees were announced in fiscal year 2010 (see Physics Today, December 2009, page 26

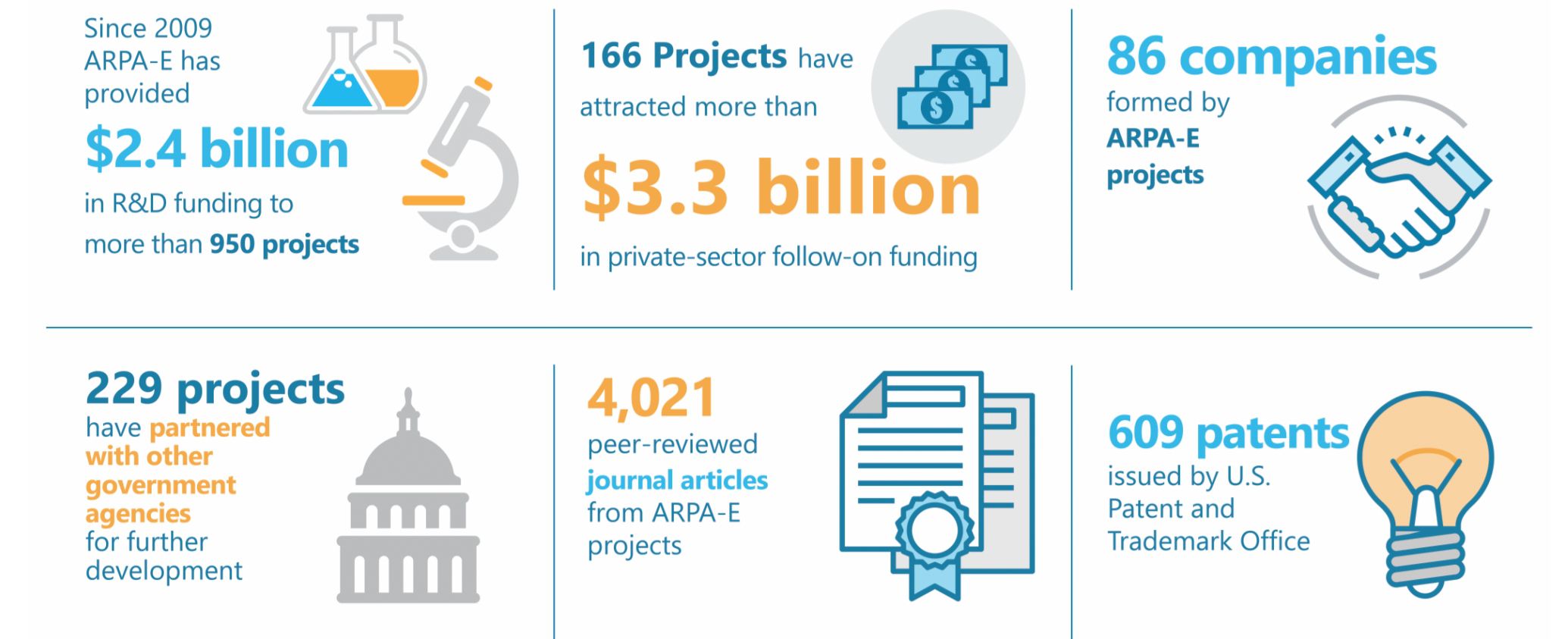

The Advanced Research Projects Agency–Energy was created to support the development of high-risk but potentially transformational clean-energy technologies. Housed in the US Department of Energy, ARPA–E issued its initial awards in fiscal year 2010. (Courtesy of ARPA–E.)

Unlike traditional R&D grant programs, ARPA–E empowers its program managers to take a hands-on approach. If a project fails to progress, it can be quickly terminated at the manager’s discretion. Given the high-risk nature of the R&D, failure rates are expected to be higher than for grants from EERE or DOE’s other applied energy research programs.

Goldstein says it’s important to compare the startup successes of ARPA–E programs with those of less risky research projects. “If you got political opposition to ARPA–E that asks why the government should be taking high-risk bets, it bakes in the assumption that these high-risk projects are going to do worse and be more of a loss for public dollars. It’s important to know that’s not the case.”

An ARPA–E spokesperson says the Nature Energy study failed to take into account startups that resulted from university research sponsored by ARPA–E. One such project at Stanford University led to the advanced-battery startup QuantumScape, which recently announced it will go public in December at an anticipated evaluation of $3.3 billion.

David Danielson, of the Bill Gates–backed Breakthrough Energy Ventures investment firm, says he identified $230 million more in VC that was raised through 2017 by the ARPA–E startups that wasn’t included in the study’s total. If that sum were added to venture funding raised by QuantumScape, three other university spinoffs, and Vionx, a spinoff from United Technologies, all of which were backed by ARPA–E, total VC would nearly double the $984 million listed in the study. Goldstein replies that the study’s methodology considered only startups that were already incorporated at the time of the award, “so we could be comparing apples to apples” between ARPA–E recipients and the other categories.

In his own analysis of the study, Danielson, a former assistant secretary of EERE and the initial program director at ARPA–E, also counted more startup failures than Goldstein found. But he says higher failure rates are expected from ARPA–E’s “high-risk moonshots.”

Acquisitions, another metric used in the Goldstein study, more often than not are an indication of failure, Danielson says. When startups throw in the towel, they will usually find someone willing to buy the technology they failed to commercialize—for far less than the sellers had sunk into it.

Breakthrough Energy Ventures itself has invested in 10 ARPA–E startups, including QuantumScape.

The innovation ecosystem

Arunava Majumdar, a Stanford engineering professor who was the inaugural ARPA–E director, says the agency was never intended to bridge the valley of death. “ARPA–E’s job is not to create businesses. It is to do research on breakthrough technologies that could eventually become the foundation of entire new industries.” He says the Goldstein report highlights a systemic issue in the innovation ecosystem: “There are these valleys of death. I don’t think anyone is immune to it. You may have the best technology you can develop … but it will still have to go through the same gauntlet of trying to raise money and face the valleys of death beyond ARPA–E. That needs fixing.”

In September ARPA–E announced the initial awards of a new program meant to help bridge that gap by supporting full-scale technology demonstrations. The SCALEUP program (Seeding Critical Advances for Leading Energy technologies with Untapped Potential) will provide $19.9 million to Natron Energy for sodium-ion battery development and $4.6 million to Bridger Photonics for the aerial detection of methane leaks from oil and gas infrastructure. More SCALEUP awardees are expected to be announced in January.

Norm Augustine, a retired Lockheed Martin CEO, chaired a 2007 report from the National Academies Press that urged ARPA–E’s creation. The agency’s greatest achievement, he says, has been to add more than $3 billion in new research funding for clean energy, but he added that its budget should be three times larger. As for evaluating its performance, “the ideal measure would be how many tons of carbon were removed from the atmosphere or how many tons per joule were not put into the atmosphere due to ARPA–E, but that’s probably impossible to figure.”

Augustine discounts patents as a performance metric. “It’s common practice in some places that where one patent would do, you get four or five because it makes you look better to your funder or boss. On the other hand, some large companies are very reluctant to get patents because it just gives it away to the world the avenue of research you are pursuing.” Augustine puts more weight on the number of startups created and the amount of industry investment attracted.

Danielson thinks ARPA–E may be best judged not by the number of successes and failures, but by its “transformational outcomes,” measured by the number and frequency of companies valued at $1 billion or more that have resulted from sponsored projects. In addition to QuantumScape, two other companies fit that bill: advanced-battery company Sila Nanotechnologies, privately valued at more than $1 billion, and the custom-organism-engineering company Gingko Bioworks, which he says is privately valued at $4.2 billion. The total $8.5 billion valuation of the three is about 2.5 times the $3.3 billion total ARPA-E funding to date. “That can be loosely thought of as a 19% equivalent annual rate of return on taxpayer funds,” he says.

Investors needed

Organizations such as the Engine, launched in 2016 by MIT to be an incubator and source of long-term capital for disruptive technologies, and Breakthrough Energy Ventures are evidence of growing investor interest in clean energy since the 2010–17 investment window covered in the Goldstein study, says Addison Stark, a former ARPA–E acting program director now with the Bipartisan Policy Center. “The fundamental story is that ARPA–E has existed for 10 years and we know that innovation in hard technology and energy technology occurs over decades,” he says.

The market demand to attract more private investment could be generated by a tax on carbon emissions or by regulations such as clean energy standards, says Majumdar. Demand could also be created by government procurement of low-carbon products. “Anyone who wants to create something needs a place to sell. Without selling, the pipeline is clogged.”

As for financing, Majumdar says the VC model doesn’t work for energy technologies, given that VC can get factor-of-six returns in five years from investing in software. “That whole ecosystem needs to be fixed, and that’s not the job of ARPA–E. It’s the job to some extent of the federal government to prime the pump and provide the incentives for private capital to be unleashed.”

“We know the private sector has struggled with funding full-scale technology demonstrations,” says Stark. Of five fossil-fuel plant carbon capture technology demonstrations that were initiated with government funding, only the smallest, the Petra Nova plant south of Houston, Texas, was a success.

On the other hand, the five utility-scale solar energy demonstrations that were built by companies and private consortiums with the help of $4.6 billion in federal loan guarantees continue to operate today. Solar has benefited from decades of federal R&D, tax credits, and consistent policies. But carbon capture has been plagued by technical difficulties, cost and schedule overruns, and inconsistent support from government.

Updated 26 November 2020: The next-to-last paragraph was updated to indicate that only carbon capture technology demonstrations attached to fossil-fuel plants were being discussed.

More about the authors

David Kramer, dkramer@aip.org